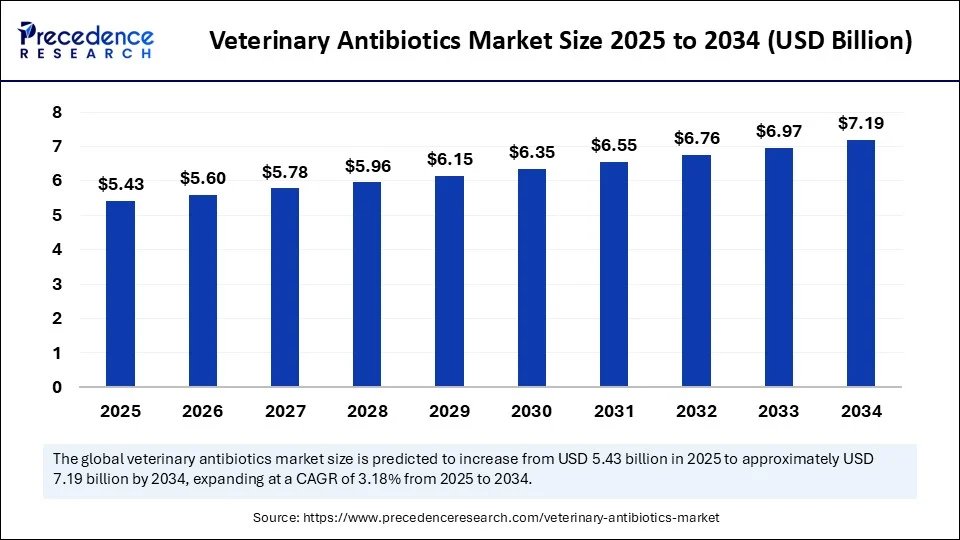

The global veterinary antibiotics market size reached USD 5.26 billion in 2024 and is projected to surpass around USD 7.19 billion by 2034, at a CAGR of 3.18% from 2025 to 2034. This steady growth is driven by the rising demand for high-quality animal protein, advancements in veterinary diagnostics, and a growing pet population globally.

Livestock remains the core focus of antibiotic use, particularly in regions dependent on commercial farming. However, the companion animal segment is emerging as a major growth driver. Urbanization, pet humanization, and wellness trends are increasing veterinary visits and boosting demand for specialized treatments, including safer and targeted antibiotics.

Veterinary Antibiotics Market Key Points

- In terms of revenue, the global veterinary antibiotics market was valued at USD 5.26 billion in 2024.

- It is projected to reach USD 7.19 billion by 2034.

- The market is expected to grow at a CAGR of 3.18% from 2025 to 2034

- Asia Pacific dominated the veterinary antibiotics market with the largest share of 38% in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the tetracyclines segment led the market while holding a 29% share in 2024.

- By product type, the fluoroquinolones segment will grow at a significant CAGR between 2025 and 2034.

- By route of administration, the oral segment dominated the market with a 45% share in 2024.

- By route of administration, the injectable segment will grow at the highest CAGR between 2025 and 2034.

- By animal type, the livestock segment contributed the largest market share of 36% in 2024.

- By animal type, the companion animals segment will expand at a significant CAGR between 2025 and 2034.

- By mode of delivery, the prescription-based segment led the market while holding a 62% share in 2024.

- By mode of delivery, the over-the-counter (OTC) segment will grow at the fastest CAGR between 2025 and 2034.

- By end-user, the animal farms segment held the major market share of 48% in 2024.

- By end-user, the online veterinary pharmacies segment is expected to grow at the fastest rate between 2025 and 2034.

- By distribution channel, the distributors/wholesalers segment dominated the market with a 52% share in 2024.

- By distribution channel, the online platforms segment will grow at a significant CAGR between 2025 and 2034.

Get a Sample: https://www.precedenceresearch.com/sample/6408

The Growing Importance of Veterinary Antibiotics

Veterinary antibiotics are fundamental to global animal healthcare. From preventing bacterial infections in livestock to treating ailments in household pets, these drugs are essential for maintaining animal welfare, food safety, and public health. As veterinary science evolves, so does the market for antibiotics specifically tailored for animals.

Key Drivers and Emerging Opportunities

Escalating Livestock Diseases and Productivity Pressures

The global intensification of animal farming has led to a rise in infectious diseases such as mastitis, respiratory infections, and gastrointestinal disorders in livestock. Antibiotics continue to serve as critical tools in ensuring timely treatment, reducing mortality rates, and maintaining food production efficiency—especially in poultry, cattle, and swine.

Rising Demand for Animal Protein and Food Safety

A surge in meat and dairy consumption—particularly in Asia, Africa, and Latin America—is fueling the need for healthier livestock. Ensuring food safety standards and export-readiness necessitates robust veterinary care, with antibiotics playing a central role in disease prevention and control throughout the supply chain.

Artificial Intelligence Driving Drug Discovery

Artificial intelligence (AI) is reshaping veterinary pharmaceutical research. From predicting bacterial resistance patterns to identifying novel compounds, AI significantly reduces drug development timelines. Startups and major players alike are integrating AI platforms into R&D to enable smarter, more personalized antibiotic solutions for various animal species.

Shift Toward Animal-Specific Antibiotics and AMR Mitigation

Global attention on antimicrobial resistance (AMR) is triggering a strategic pivot toward animal-only antibiotics—those not used in human medicine. This separation reduces the risk of resistance transfer and encourages pharmaceutical firms to focus on species-specific microbial challenges, fostering innovation in safer antibiotic development.

Regulatory Landscape and Market Constraints

Stringent Oversight from Global and Regional Authorities

Governments and health authorities are tightening their regulations on veterinary antibiotics. In the United States, the FDA has implemented guidelines requiring veterinary oversight for medically important antibiotics. In India, the FSSAI has introduced limits on antibiotic residues in animal products. Meanwhile, the European Medicines Agency (EMA) continues to lead the way with comprehensive antimicrobial stewardship protocols.

These frameworks, while critical for safeguarding public health, often increase the cost and complexity of bringing new antibiotics to market. Small and mid-sized manufacturers may face regulatory hurdles that impede market entry or innovation.

Antimicrobial Resistance as a Growing Threat

AMR presents a two-sided challenge: it necessitates innovation but also leads to regulatory restrictions on older, widely used antibiotics. Governments worldwide are promoting judicious antibiotic usage in veterinary medicine, resulting in usage caps, bans on prophylactic treatments, and greater emphasis on vaccination and alternative therapies.

Regional Analysis: Market Dynamics Around the World

Asia Pacific: Current Leader with Expanding Policy Infrastructure

Asia Pacific dominated the market in 2024, largely due to the scale of its livestock industries in China and India. Rising income levels and food safety demands are enhancing veterinary service adoption. Initiatives like India’s State Veterinary Therapeutics Guidelines (SVTG) are guiding the prudent use of antibiotics, reflecting the region’s evolving regulatory maturity.

North America: Fastest-Growing Market with Companion Animal Focus

The North American market, especially the U.S., is witnessing rapid growth due to high pet ownership, advanced veterinary infrastructure, and increasing awareness of pet wellness. The FDA’s proactive approach to AMR and prescription drug usage bolsters market integrity while encouraging innovation. The companion animal antibiotics segment is seeing robust expansion here.

Europe: Policy-Driven and Sustainability-Focused

Europe continues to lead in veterinary antibiotic regulations, emphasizing sustainable livestock management. The EMA publishes regular surveillance reports and promotes judicious use through One Health frameworks. Regional programs are now focusing on reducing group treatments in farms and implementing precise diagnostic tools before antibiotic administration.

Latin America and Middle East & Africa: Emerging with Promise

Countries like Brazil, Mexico, South Africa, and the UAE are rapidly improving veterinary services and access to antibiotics. These regions are viewed as emerging markets with significant growth potential, especially for livestock-targeted treatments and AMR education programs.

Market Coverage

| Report Attribute | Details |

| Market Size by 2034 | USD 7.19 Billion |

| Market Size in 2025 | USD 5.43 Billion |

| Market Size in 2024 | USD 5.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.18% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Route of Administration, Animal Type, Mode of Delivery, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights: Breaking Down the Market

Product Type

-

Tetracyclines continue to dominate due to their affordability and broad-spectrum action against common pathogens.

-

Fluoroquinolones are gaining traction thanks to their advanced efficacy and low incidence of bacterial resistance.

Route of Administration

-

Oral antibiotics are the most widely used, particularly in livestock.

-

Injectable formulations are growing in popularity in small animal practice and for treating critical conditions.

Animal Type

-

Livestock accounts for the largest share, driven by large-scale commercial farming.

-

Companion animals, including dogs, cats, and horses, are contributing to a growing segment, especially in developed nations.

Mode of Delivery

-

Prescription-based sales dominate due to global regulatory pressures.

-

Over-the-counter (OTC) antibiotics are still prevalent in some markets but are facing increasing scrutiny.

End-User

-

Animal farms and veterinary clinics are the primary consumers of antibiotics.

-

Online veterinary pharmacies are the fastest-growing end-user segment, providing digital consultation and doorstep medicine delivery.

Distribution Channel

-

Distributors and wholesalers remain the core distribution channels.

-

E-commerce platforms are growing steadily, providing improved access in remote or underserved areas.

Read Also: Complex Rehab Technology Market Size to Reach USD 23.76 Bn by 2034

Technology Spotlight: The Rise of AI in Veterinary Antibiotics

Artificial intelligence is unlocking a new era of smart veterinary care. In diagnostics, AI is helping vets quickly identify pathogens using image recognition and digital lab analysis. In treatment, AI engines can tailor antibiotic regimens based on symptoms, species, and prior response history.

Moreover, AI-driven R&D platforms enable pharmaceutical firms to simulate drug-pathogen interactions and assess AMR risks early. This innovation reduces R&D costs and paves the way for customized, safe, and effective therapies in both companion and livestock animals.

Notable Developments and Product Launches

Dechra’s Otiserene Gets FDA Nod

In May 2025, Dechra Pharmaceuticals received FDA approval for Otiserene, a new combination drug designed to treat external ear infections in dogs. The formulation promises quicker recovery and reduced resistance build-up.

Elanco Launches Credelio Quattro

Elanco Animal Health launched Credelio Quattro in January 2025—a chewable tablet offering protection against fleas, ticks, and common bacterial infections. This innovation merges prevention and treatment, appealing to health-conscious pet owners.

Strategic Collaborations and Investments

-

Zoetis announced a partnership with InSilicoVet to develop AI-based AMR surveillance tools for veterinary clinics.

-

Boehringer Ingelheim expanded into Africa, acquiring regional firms to strengthen its presence in underserved livestock markets.

Future Outlook: Toward a Balanced, Intelligent Market

The next decade will be defined by the intersection of innovation and accountability. Online veterinary services will continue to rise, bringing convenience and diagnostic precision to rural and urban consumers alike.

Sustainability will be a guiding principle—companies must invest in species-specific antibiotics, green manufacturing, and post-market surveillance. Growth opportunities lie in emerging economies, aquatic animal care, and companion animal wellness, with AI and digital health as enablers of change.