Market Overview

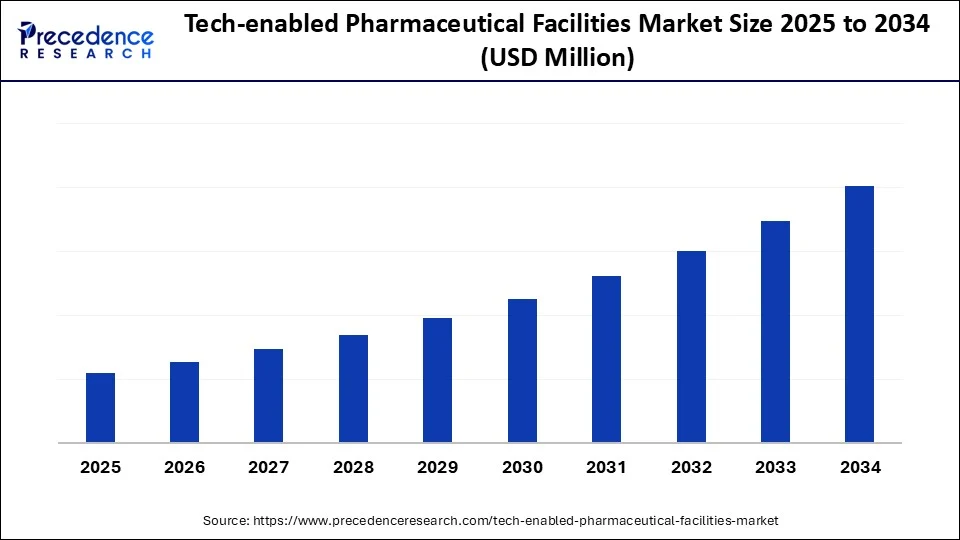

Tech‑enabled pharmaceutical facilities combine Industrial Internet of Things (IIoT) devices, AI, machine learning, robotics, digital twins, cloud‑based manufacturing execution systems (MES), advanced analytics, cybersecurity and blockchain. These technologies create intelligent manufacturing environments where equipment and processes are monitored in real time, allowing predictive maintenance, rapid adjustments and compliance with stringent regulations. Demand for better quality drugs, faster production and cost efficiency is driving adoption of such facilities. The base year for the market analysis is 2024, with forecasts running to 2034.

Key Takeaways

-

Regional dominance: North America dominated the market in 2024. Asia Pacific is forecast to post the fastest compound annual growth rate (CAGR) between 2025 and 2034.

-

Facility type: Manufacturing facilities accounted for the largest market share in 2024, while modular and mobile pharma facilities are expected to grow fastest, thanks to their scalability and rapid deployment.

-

Technology: IoT and smart sensors led the technology segment in 2024. AI and machine‑learning technologies are forecast to grow at the highest rate.

-

Application: Drug manufacturing (active pharmaceutical ingredients and formulations) held the largest application share in 2024; personalized and precision medicine manufacturing is expected to expand rapidly.

-

End users: Pharmaceutical manufacturers were the largest end‑users, while contract development and manufacturing organisations (CDMOs) are projected to grow fastest.

-

Deployment: Retrofit/upgrade of existing facilities generated the largest revenue share in 2024; modular or plug‑and‑play smart units will grow fastest.

Get a sample: https://www.precedenceresearch.com/sample/6431

Growth Factors

Adoption of Pharma 4.0

Pharma companies are embracing Industry 4.0 tools—including AI, robotics and IoT—to enhance traceability, quality assurance and production efficiency. These technologies support compliance with global regulatory expectations and enable continuous manufacturing.

Demand for Flexible Manufacturing

Pandemics, personalized medicine and rare‑disease therapies require agile production. Modular and technology‑driven facilities can be reconfigured quickly to produce small batches and different drugs. Their plug‑and‑play design allows rapid deployment with lower infrastructure costs, making them suited to decentralized manufacturing and emergency response.

Regulatory Push for Data Integrity

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) encourage real‑time monitoring and data transparency. In India, the Pharmaceuticals Technology Upgradation Assistance Scheme (RPTUAS) provides subsidies and interest assistance to small and medium manufacturers to upgrade facilities to meet new Good Manufacturing Practice (GMP) requirements. The new Schedule M regulations effective 29 Jun 2024 mandate digital traceability through QR codes and barcodes, pushing manufacturers to adopt automation and smart infrastructure.

Expansion of Biopharma and Cell Therapies

Complex biologics and cell therapies demand tightly controlled environments that rely on digital infrastructure and smart manufacturing solutions. Facilities equipped with digital twins, robotics and single‑use systems are essential to meet these requirements.

Market Dynamics

Drivers

Personalized medicine is a major driver. Therapies tailored to individual genetics require flexible, data‑driven production lines that incorporate automation, real‑time analytics and digital batch records. Companies like Novartis and Roche invest in modular and smart manufacturing platforms to produce smaller batches of multiple drugs.

Government incentives and regulatory programmes accelerate adoption. India’s RPTUAS offers up to 20 % reimbursement or interest subvention to modernize facilities, encouraging manufacturers to install clean rooms, testing labs, HVAC systems and QA systems.

Restraints

Regulatory uncertainty remains a key barrier. In a 2023 report, the U.S. Government Accountability Office noted that the FDA supports advanced manufacturing but lacks clear requirements or metrics to evaluate initiatives, deterring investment. Differences in regulatory frameworks worldwide complicate post‑approval changes, making companies cautious about adopting new technologies.

Opportunities

Combining AI‑driven automation with Pharma 4.0 digital platforms presents a significant opportunity. Integrating AI, robotic process automation (RPA) and digital twins can dramatically improve quality, speed and resilience. In India, Eisai Pharma plans to launch a global capability centre focused on digital innovation, reflecting growing demand for in‑country technical infrastructure. Such centres will accelerate adoption of AI, IoT and digital twin technologies and generate productivity gains without relying solely on increases in market size or conventional CAGR measures.

Facility Type Insights

Manufacturing facilities captured the largest share in 2024 because these plants manufacture APIs, formulations and finished products. IoT and robotics improve operational efficiency, reduce human error and ensure compliance with “quality by design” standards.

Modular and mobile facilities are expected to grow fastest. These units offer scalability and location flexibility, enabling manufacturers to rapidly adjust production capacity during pandemics or when launching personalized therapies. Their compact, prefabricated design allows quick installation with lower infrastructure costs and supports decentralized manufacturing.

Technology Insights

IoT and smart sensors lead the technology segment. These devices collect real‑time data on equipment performance and environmental conditions, enabling predictive maintenance and ensuring product consistency. Smart sensors track temperature, humidity, pressure and contamination—critical parameters in regulated environments.

AI and machine learning are expected to grow fastest. AI‑enabled systems optimise production scheduling, identify deviations and strengthen quality assurance through pattern recognition. As manufacturers seek more responsive systems, AI and ML will be increasingly adopted to boost precision, efficiency and scalability.

Application Insights

Drug manufacturing (APIs and formulations) dominated the application segment in 2024 because smart technologies enhance precision, consistency and regulatory compliance. Automation, IoT‑enabled equipment and real‑time monitoring reduce waste and improve quality control.

Personalized/precision medicine manufacturing is projected to grow fastest. This segment focuses on producing therapies tailored to individual genetic profiles or specific disease conditions. Tech‑enabled facilities employ AI, robotics and digital twins to support small‑batch, high‑complexity manufacturing. Modular systems and flexible lines enable rapid transitions between therapies.

End‑User Insights

Pharmaceutical manufacturers (branded and generic) were the largest end‑user segment in 2024. These companies are investing heavily in smart technologies to improve efficiency, ensure compliance and enable continuous production.

Contract development and manufacturing organisations (CDMOs) are expected to be the fastest‑growing end‑users. CDMOs use smart units, AI and flexible designs to provide agile, scalable production services for clients producing a range of drug types, including biologics and personalized medicines.

Deployment Type Insights

Retrofitting/upgrading existing facilities generated the largest revenue share in 2024. Many pharmaceutical companies are updating their plants with IoT sensors, automation and digital controls to extend asset life, improve efficiencies and meet evolving regulations.

Modular or plug‑and‑play smart units are projected to grow fastest. These pre‑engineered systems allow quick deployment and scalability, enabling companies to address changing production needs and operate in remote or temporary locations. Remote monitoring and AI‑driven automation make these units efficient and future‑ready.

Regional Insights

North America

North America led the market in 2024 due to rapid modernization, established infrastructure and widespread adoption of digital technologies. Over 1,200 facilities have been upgraded to smart automation since early 2023, driven by U.S. FDA encouragement of continuous manufacturing. Companies such as Johnson & Johnson and GlaxoSmithKline have expanded production facilities to enhance precision, speed and reliability.

In the U.S., Eli Lilly doubled its investment to US$9 billion in a new API facility in Indiana to increase domestic production. Thermo Fisher Scientific expanded sterile injectable capacity, while Amgen and Pfizer established digitalized pilot plants to prepare for commercial production. Policies aimed at reshoring manufacturing and strengthening supply chains have accelerated adoption of smart technologies.

Asia Pacific

Asia Pacific is expected to be the fastest‑growing region. Government initiatives to improve healthcare infrastructure, expanding pharmaceutical manufacturing capacity and adoption of smart technologies drive growth. South Korea is investing $585 million in domestic AI research and development in 2024. AstraZeneca is investing $2.5 billion to expand its Beijing smart pharmaceutical campus to focus on AI‑enabled drug discovery and digitized manufacturing. WuXi Biologics is expanding manufacturing facilities across Wuxi, Shanghai and Hangzhou to increase biopharma production using single‑use bioreactors and data‑supported quality controls.

Other Regions

Europe, Latin America, and the Middle East & Africa are also adopting tech‑enabled pharmaceutical facilities. European countries benefit from supportive regulatory frameworks and collaborations between academia and industry. Latin America and the Middle East & Africa are investing in modernizing pharmaceutical infrastructures to meet global GMP standards and improve access to healthcare.

Leading Companies

The report identifies numerous technology providers and pharmaceutical manufacturers driving the market. Major players include Siemens Healthineers, GE HealthCare, Schneider Electric, Honeywell International, Bosch Rexroth, IBM Watson Health, Rockwell Automation, ABB Group, Emerson Electric, Yokogawa Electric, Thermo Fisher Scientific, Sartorius, Cytiva (Danaher), Lonza Group, WuXi AppTec, Pfizer Global Supply, GEA Group, Tetra Pak Pharma, Merck KGaA (MilliporeSigma) and Optel Group. These companies supply smart manufacturing solutions, automation systems, AI platforms, process equipment and integrated software.

Read Also: Inside the Booming PCR Technologies Market: What’s Driving a USD 31.39 Billion Future?

Recent Deals and Investments

-

July 2025 – JCR Pharmaceuticals and Acumen Pharmaceuticals formed a collaboration to develop Alzheimer’s treatments using JCR’s J‑Brain Cargo® technology to enhance drug delivery across the blood–brain barrier.

-

February 2025 – Fengate and eMAX Health entered a partnership to modernize healthcare technology and develop data‑driven, tech‑enabled medical infrastructure.

-

April 2025 – Novartis announced a US$2.3 billion investment to expand U.S. manufacturing and R&D facilities, underscoring its commitment to advanced production capabilities.

-

October 2024 – Zephyr, a tech‑enabled home‑services platform, launched with almost $100 million in capital to integrate digital infrastructure and advanced technology for service optimization.

Segmentation

The market is segmented by facility type (manufacturing facilities, R&D facilities, packaging & labeling units, distribution centres, quality control labs, modular & mobile facilities, contract/outsourced facilities), technology (IoT & smart sensors, AI & ML, robotics & process automation, digital twin, advanced process control, cloud‑based MES, blockchain, cybersecurity & IT, AR/VR, edge computing & analytics), application (drug manufacturing, clinical trials & research, biologics & biosimilars production, personalized/precision medicine manufacturing, pharmaceutical packaging & serialization, cold chain logistics, regulatory & quality compliance monitoring, process optimization & predictive maintenance), end‑user (pharmaceutical manufacturers, biotechnology companies, CDMOs, contract research organizations, regulatory/government agencies, academic & clinical research institutes), deployment type (new build, retrofit/upgrade, modular/plug‑and‑play, hybrid), and region (North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa).