How Big is the Spinning Machinery Market?

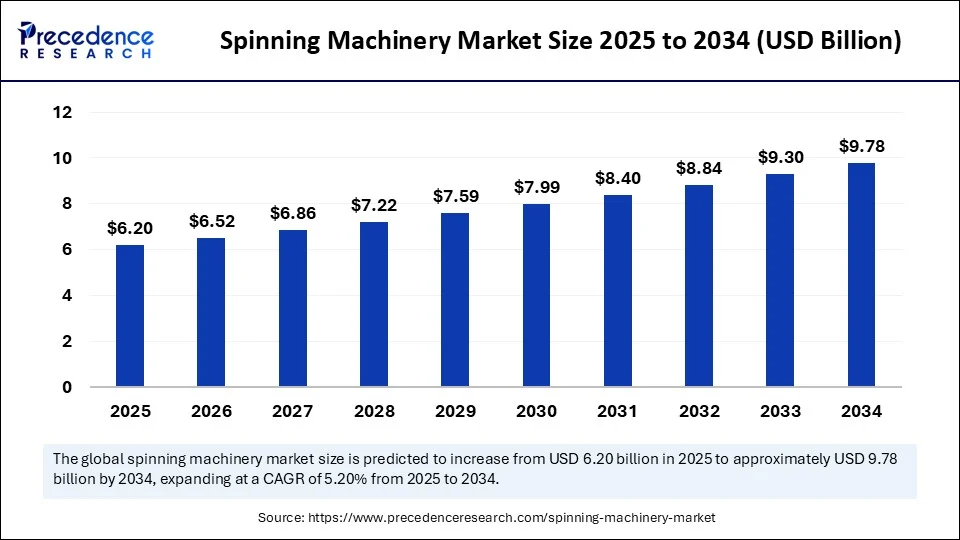

As of 2024, the global spinning machinery market was valued at USD 5.89 billion and is projected to grow at a CAGR of 5.20% between 2025 and 2034, reaching an estimated USD 9.78 billion by the end of the forecast period. This robust expansion is fueled by:

-

Growing yarn demand from fashion and technical textiles

-

Increasing deployment of automated spinning systems

-

Strong export-oriented growth in Asia Pacific

-

Shift toward sustainable and energy-efficient textile equipment

The market’s growth trajectory aligns with broader developments in the textile machinery market, as manufacturers streamline operations with smarter, more productive spinning solutions.

The global textile sector is undergoing a rapid technological transition, with the spinning machinery market standing at the forefront of this change. As the demand for high-quality yarn continues to soar across applications like apparel, home textiles, and industrial fabrics, spinning machinery is evolving to meet these expectations through automation, artificial intelligence (AI), and sustainability-driven innovations. From ring spinning machines to automated spinning lines, manufacturers are reimagining efficiency and output. This transformation isn’t just a trend—it’s becoming a core business imperative for modern textile operations.

According to Precedence Research, the spinning machinery market is poised for steady growth during the forecast period 2025–2034, driven by surging global textile demand, advancements in energy-efficient machinery, and the emergence of smart factories. With rising investments in AI in textiles and industrial automation, this market is entering a new era of intelligent, scalable, and environmentally responsible production.

Get a Sample: https://www.precedenceresearch.com/sample/6411

Why is Automation Driving Growth?

Automation in spinning machinery is no longer a futuristic concept—it’s a present-day necessity. Key players are integrating robotics, sensor-based control systems, and predictive maintenance into machines to minimize labor dependency and optimize yarn quality. For instance:

-

Automated roving frames and winding machines reduce manual handling errors

-

Real-time defect detection through IoT-enabled sensors enhances consistency

-

PLC-driven control systems boost production uptime

These innovations not only improve productivity but also help address labor shortages in developed economies. In regions like India and Bangladesh, automation supports large-scale exports by ensuring consistency and minimizing operational costs.

Automation’s influence is also evident in industrial automation trends, where machinery across sectors is moving toward self-regulating systems.

How is AI Reshaping the Textile Machinery Landscape?

Artificial Intelligence (AI) is adding intelligence to efficiency. In the spinning industry, AI is redefining quality assurance and process optimization. Examples include:

-

AI-based yarn grading systems for real-time quality control

-

Predictive analytics for spindle and bearing wear

-

Computer vision for color matching and thread uniformity

These capabilities enable manufacturers to deliver better products faster while reducing resource wastage. AI also plays a vital role in predictive maintenance, allowing proactive action before machinery failures occur—thereby reducing downtime and improving ROI.

Learn more about the broader scope of artificial intelligence in manufacturing and how it intersects with textiles.

What Role Do Sustainable Machines Play?

In today’s textile economy, sustainability is a competitive edge. Energy consumption, water usage, and carbon emissions are under constant scrutiny. As a result, there is growing demand for:

-

Energy-efficient spinning machines with low power motors

-

Machines that support recycled fibers and natural yarns

-

Eco-friendly lubrication systems and waste management protocols

Companies are shifting toward closed-loop spinning processes, integrating sustainable spinning frames that reduce waste and improve recyclability. This aligns with consumer preferences for ethically produced garments and sustainability reporting by textile brands.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.78 Billion |

| Market Size in 2025 | USD 6.20 Billion |

| Market Size in 2024 | USD 5.89 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Machine Type, Operation Type, Material Type, End-Use Industry, Spinning Process, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & A |

Key Market Segmentation Insights

1. By Machine Type

-

Ring Spinning Machines dominate the market due to their versatility and widespread adoption in cotton and synthetic yarns. They deliver high-quality, fine yarn with consistent output, making them indispensable for premium apparel production.

-

Rotor Spinning Machines are gaining traction in high-volume, coarse yarn production for industrial and home textiles.

-

Air-Jet Spinning Machines are emerging as energy-efficient alternatives suitable for synthetic blends, offering faster speeds and reduced labor needs.

2. By Operation Type

-

Automatic Spinning Machines are gaining significant market share due to rising labor costs and the need for uninterrupted operations. These systems integrate robotic arms, automatic bobbin changers, and self-cleaning systems.

-

Semi-automatic Machines still hold a large share in developing economies where initial investment in full automation remains a barrier.

3. By Material Type

-

Cotton Spinning Machinery remains dominant owing to global demand for breathable, natural fabrics.

-

Synthetic Fiber Spinning Machines (e.g., polyester, nylon) are expanding rapidly with the rise in performance and blended textiles.

-

Wool and Specialty Fiber Spinning are niche but growing in premium and winterwear segments.

4. By End-Use Industry

-

Apparel Industry leads the market due to fast fashion, rising middle-class consumption, and online retail expansion.

-

Home Textiles (bedsheets, curtains, upholstery) are driving demand for thicker yarns, boosting rotor machine adoption.

-

Technical Textiles (automotive fabrics, medical textiles, protective wear) are growing swiftly, requiring specialized spinning processes.

5. By Spinning Process

-

Carded Yarn processes dominate in terms of volume, particularly in coarse and standard textile applications.

-

Combed Yarn is increasingly in demand for high-quality fashion applications that require finer and softer yarns.

-

Compact Spinning is gaining attention for its ability to produce strong, uniform yarns with minimal hairiness—ideal for performance fabrics.

6. By Sales Channel

-

Direct Sales account for a major share, particularly in large-scale textile mills that require tailored machinery.

-

Distributors and Dealers serve small-to-medium textile enterprises, especially in fragmented markets like Southeast Asia and Africa.

-

Online Sales Channels are still nascent but gaining relevance as manufacturers digitize their sales outreach.

Why is Asia Pacific Dominating the Market?

Asia Pacific leads the global spinning machinery market by a wide margin and is expected to retain its dominance through 2034. Several structural factors support this:

-

Abundant labor and favorable textile policies in countries like India, Bangladesh, and Vietnam

-

Presence of leading textile hubs and export ecosystems

-

Government-backed incentives and textile parks under initiatives like India’s PLI Scheme

-

Rapid urbanization and rising disposable incomes fueling domestic apparel demand

With major yarn producers based in the region and continuous investments in modernizing plants, Asia Pacific remains the epicenter of global spinning innovation.

Read Also: Laser Welding Machine Market Size to Worth USD 5.57 Billion by 2034

Country-Level Insights: India, China, Bangladesh & Vietnam

India

India is rapidly becoming a spinning machinery powerhouse, thanks to its extensive cotton production, strong domestic market, and increasing exports to Europe and the U.S. The government’s Production-Linked Incentive (PLI) scheme and robust textile clusters in Tamil Nadu and Gujarat support the adoption of automated spinning lines and AI-enabled machinery.

China

Although experiencing rising labor costs, China continues to be a leader in automated textile manufacturing. It is investing heavily in smart factories, robotics, and energy-efficient spinning technology to maintain global competitiveness.

Bangladesh

As a garment-exporting nation, Bangladesh is investing in modern ring spinning machines to ensure fabric quality and reduce reliance on imports. Strong demand from European fashion brands is propelling modernization efforts.

Vietnam

Vietnam’s FDI-backed textile sector is moving toward vertical integration. Manufacturers are investing in AI-powered spinning machines to increase production capacity while maintaining premium quality standards.

Who are the Major Players and What are They Doing?

Key players in the global spinning machinery market include:

-

Rieter AG

-

Saurer AG

-

Murata Machinery Ltd.

-

Toyota Industries Corporation

-

Trützschler Group

-

Marzoli Machines Textile S.r.l

-

Lakshmi Machine Works Ltd. (LMW)

These companies are focusing on:

-

R&D investment in AI and automation

-

Strategic partnerships with local dealers

-

Launching eco-friendly spinning models

-

Integrating IoT for remote diagnostics and support

Their continuous innovation is pushing the boundaries of what spinning machines can achieve, especially in terms of quality, energy savings, and digital monitoring.

Recent Developments and Strategic Moves

-

In 2024, Rieter launched an AI-based monitoring system that predicts machine wear and prevents downtime.

-

Saurer Group partnered with a leading German automation firm to co-develop smart spinning frames for real-time optimization.

-

LMW introduced a fully automated ring spinning machine integrated with cloud-based analytics tools in early 2025.

-

Multiple players have also started leasing models and trade-in programs, encouraging older mills to upgrade machinery without incurring high capital expenditure.