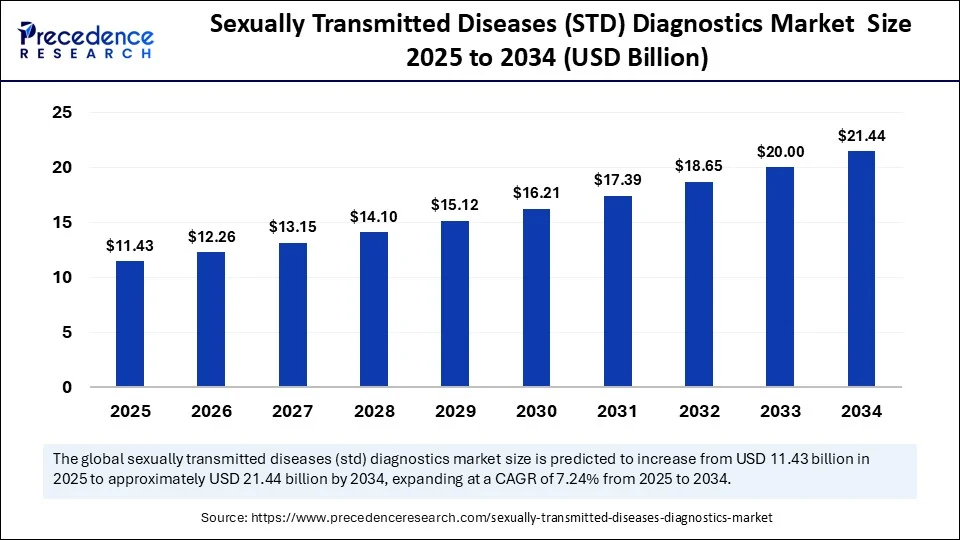

The global sexually transmitted diseases (STD) diagnostics market size accounted for USD 10.66 billion in 2024 and is predicted to increase from USD 11.43 billion in 2025 to approximately USD 21.44 billion by 2034, expanding at a CAGR of 7.24% from 2025 to 2034. At-home diagnostic testing is revolutionizing the way individuals access and manage their sexual health. From self-collection kits to AI-driven diagnostic tools, this transformation is particularly impactful in low-resource and high-burden regions, where traditional healthcare systems often fall short. The rise of home-based STD diagnostics is not just a technological shift—it is a public health breakthrough with the potential to normalize testing, reduce stigma, and enable early intervention for sexually transmitted infections (STIs).

Sexually Transmitted Diseases (STDs) Diagnostics Market Key Points

- In terms of revenue, the global sexually transmitted diseases (STDs) diagnostics market was valued at USD 10.66 billion in 2024.

- It is projected to reach USD 21.44 billion by 2034.

- The market is expected to grow at a CAGR of 7.24% from 2025 to 2034.

- North America dominated the sexually transmitted diseases (STDs) diagnostics market with the largest market share 37.5% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR in the market between 2025 and 2034.

- By disease type/pathogen, the chlamydia trachomatis segment captured the biggest market share of 29.5% in 2024.

- By type of disease type/pathogen, the human immunodeficiency virus (HIV) segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By diagnostic technology/type, the laboratory-based tests segment contributed the highest market share of 53.50% in 2024.

- By diagnostic technology/type, the rapid point-of-care (POC) tests segment is expected to expand at a notable CAGR over the projected period.

- By sample type, the blood samples segment generated the major market share of 44.50% in 2024.

- By sample type, the urine samples segment is expected to expand at a notable CAGR over the projected period.

- By location of testing, the laboratory testing (hospitals/diagnostic labs) segment captured the highest market share of 63.50% in 2024.

- By location of testing, the home-based testing/self-testing kits segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospitals and clinics segment accounted for significant market share of 44.50% in 2024.

- By end user, the home users/individuals segment is expected to expand at a notable CAGR over the projected period.

How Are At-Home STI Kits Democratizing Access to Sexual Health?

The advent of at-home STI kits marks a pivotal step toward healthcare accessibility. These kits allow users to collect samples—such as urine, blood, or swabs, in the privacy of their own homes. Through molecular self-collection and mail-in testing services, users can receive accurate lab-verified results within days. For vulnerable populations, such as those in rural or underserved urban areas, this model eliminates travel, long wait times, and potential exposure to social judgment.

This shift is particularly beneficial in regions with limited clinical infrastructure. In parts of Asia Pacific and Sub-Saharan Africa, where clinic density is low, home-based STD diagnostics help bridge crucial access gaps. Similarly, in conservative cultures, the discreet nature of these kits encourages individuals, especially women and LGBTQ+ populations, to seek timely testing.

Telemedicine and Digital Sexual Health Services: A New Era of Confidential Care

The integration of digital sexual health services and telemedicine platforms has empowered a new generation of users to engage with sexual wellness discreetly. Online portals now offer self-assessment tools, symptom checkers, and one-click access to healthcare professionals. Platforms such as Nurx, LetsGetChecked, and MyLAB Box are redefining the end-to-end experience by combining diagnostic testing with virtual consultations, prescription services, and personalized treatment plans.

These remote diagnostic technologies not only enhance user convenience but also promote continued engagement with preventive care. Telehealth’s role in STI screening and treatment has expanded rapidly post-pandemic, creating sustainable pathways for long-term sexual health monitoring.

The Rise of AI in At-Home Diagnostics: Precision Meets Personalization

Artificial intelligence is powering a new generation of AI-driven diagnostic tools that offer clinical-grade accuracy, speed, and personalized insights. Mobile apps equipped with AI algorithms can now analyze user-reported symptoms, interpret test results, and provide risk scores based on behavioral data. This trend is driving innovation in mobile health platforms, which offer real-time, data-backed recommendations.

Moreover, AI in at-home diagnostics contributes to personalized health insights by learning from user history and behavior. For instance, predictive analytics can identify high-risk users and recommend earlier retesting, thereby enabling proactivd Diseases Diagnostics Markete STI management.

Enhancing Early Detection and Privacy with Rapid Point-of-Care Technologies

Privacy remains a critical concern in STI testing. STD rapid test kits that deliver results in under 30 minutes are increasingly gaining traction. These include lateral flow immunoassays and nucleic acid amplification tests (NAATs) that are now being miniaturized for home use.

The privacy in STI testing offered by these point-of-care solutions plays a vital role in reducing the barriers to care. Combined with discreet packaging, anonymous purchasing options, and encrypted result sharing, these tools build consumer confidence and promote repeat usage.

Regulatory Landscape: The Role of FDA-Approved Self-Test Kits

Regulatory bodies like the U.S. FDA and Europe’s CE are central to ensuring the safety and reliability of at-home testing solutions. FDA-approved self-test kits are now available for HIV, chlamydia, gonorrhea, and other STIs. The FDA’s push toward approving over-the-counter molecular diagnostic kits further signals strong institutional support for decentralized health models.

However, the regulatory frameworks across different regions remain fragmented. Harmonization of quality standards and cross-border validation will be essential as companies expand globally, especially in markets like India, Brazil, and Southeast Asia.

Decentralized Healthcare Models: Fighting Stigma and Reducing Burden

One of the greatest benefits of at-home diagnostics is the decentralization of healthcare. By moving testing out of clinics and into homes, these models reduce pressure on already burdened health systems. This approach also helps break the stigma around sexual health testing by normalizing it as a routine part of self-care, much like blood pressure or glucose monitoring.

In low- and middle-income countries, decentralized healthcare models also serve as a counterbalance to healthcare workforce shortages, logistical barriers, and infrastructure gaps.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.44 Billion |

| Market Size in 2025 | USD 11.43 Billion |

| Market Size in 2024 | USD 10.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease Type/Pathogen, Diagnostic Technology/Type, Sample Type, Location of Testing, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Outlook: Regional Penetration and Future Growth Trajectories

North America

North America leads the at-home sexual health diagnostics market, driven by rising awareness, regulatory approvals, and digital adoption. The presence of established players, high health insurance coverage, and consumer receptivity to direct-to-consumer testing drive this trend.

Asia Pacific

Asia Pacific presents the most significant growth opportunity due to a rising middle class, digital health investments, and unmet clinical needs. Innovations in affordable STI detection kits and increased smartphone penetration are fueling adoption.

Europe

Europe’s market is characterized by progressive health policies and public funding for preventive care. Countries like the UK and Germany are witnessing growing demand for clinical-grade home testing and telemedicine-integrated platforms.

Read Also: Precision Turned Product Manufacturing Market Size to Surpass USD 196.11 Billion by 2034

The Role of Surveillance and Bioinformatics in STI Prevention

STI surveillance systems and bioinformatics-based disease tracking are evolving alongside diagnostic tools. Aggregated, anonymized data from self-testing platforms feed into public health dashboards, allowing real-time trend analysis and outbreak prediction.

Governments and NGOs are exploring how self-testing data can enhance public health outreach efforts, enabling targeted education, resource allocation, and behavioral interventions at the community level.

Innovations Driving Consumer Confidence

Companies are innovating across the diagnostic pipeline to boost user adoption:

-

Sample-to-answer solutions: Fully integrated test kits that eliminate the need for lab processing.

-

Multiplex testing: Kits capable of detecting multiple infections from a single sample, such as chlamydia, gonorrhea, and syphilis.

-

Data security enhancements: End-to-end encryption and anonymized data sharing are standard, ensuring consumer trust in eHealth sexual wellness platforms.

Startups are also exploring gamified wellness tracking, subscription-based retesting programs, and behavioral nudges to promote consistent sexual health monitoring.

Conclusion: Toward a Future of Routine, Empowered, At-Home Sexual Health Care

The future of at-home diagnostic testing for sexual health is one of empowerment, privacy, and inclusivity. As consumer trust in molecular diagnostics grows and technology becomes more intuitive, self-testing will evolve into a first-line strategy for STI prevention and treatment. Regulatory momentum, AI integration, and global health equity initiatives will accelerate the shift from reactive to preventive care.

With increasing collaboration between startups and established diagnostics firms, the ecosystem is poised to redefine sexual health not just as a medical issue but as a cornerstone of holistic well-being. Routine self-testing could become as commonplace as brushing your teeth—silent, private, and powerfully preventative.