Introduction: Understanding the Role of Scroll and Absorption Chillers

Scroll and absorption chillers are essential components in modern HVAC systems used across commercial, industrial, and institutional applications. Scroll chillers use scroll compressors to provide reliable and energy-efficient cooling, especially in medium-sized buildings and modular cooling setups. They are known for their low maintenance, compact design, and high efficiency. On the other hand, absorption chillers function by using a heat source—such as steam, hot water, or exhaust gases, instead of electricity, making them ideal for waste heat recovery and sustainable cooling applications. These systems are gaining popularity as sustainability, energy efficiency, and green building certifications become central to infrastructure planning.

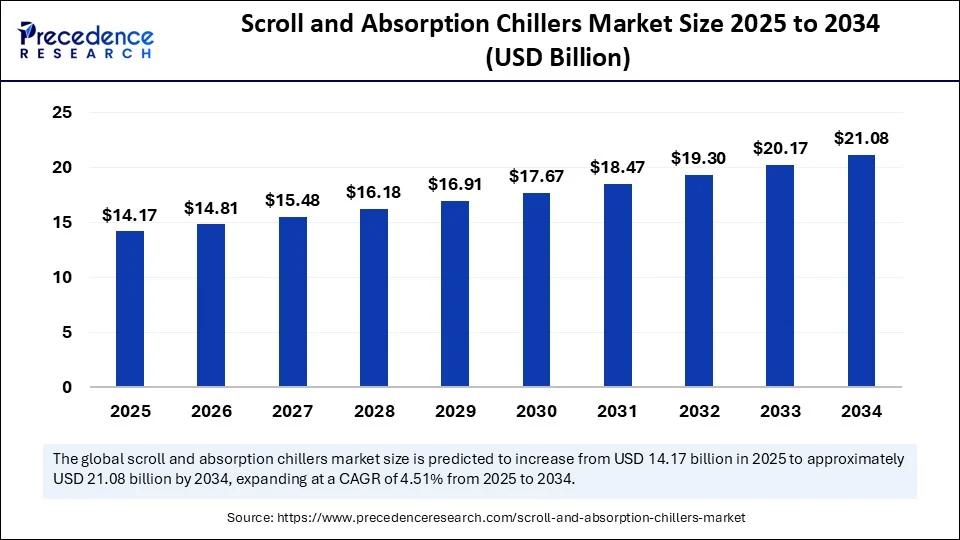

As of 2024, the global scroll and absorption chillers market stood at approximately USD 13.56 billion. With rising emphasis on clean energy and efficient indoor climate control, the market is projected to grow to USD 21.08 billion by 2034, expanding at a CAGR of 4.51%. Demand is being fueled by factors such as stricter environmental norms, the need for better indoor air quality, and the transition to green buildings across developed and emerging economies.

Strategic Takeaways for Industry Stakeholders

-

The global scroll and absorption chillers market is projected to grow at a CAGR of 4.51% from 2025 to 2034.

-

Asia Pacific remains the largest market (45%), while the Middle East & Africa is expanding the fastest.

-

Scroll chillers dominate today’s market, but absorption chillers are rapidly gaining adoption.

-

Commercial buildings and data centers are the primary application areas.

-

AI-driven features and district cooling integration are shaping the future of this market.

Get a Sample: https://www.precedenceresearch.com/sample/6387

Market Overview and Key Growth Dynamics

The scroll and absorption chillers market is undergoing a significant transformation due to the dual push of decarbonization and technological innovation. One of the key drivers is the rising cost of electricity and increased pressure on organizations to adopt sustainable HVAC systems. As a result, industries and commercial establishments are replacing outdated cooling units with advanced chillers that offer high efficiency, lower emissions, and long-term operational cost benefits.

Government initiatives to cut down carbon emissions have also played a pivotal role in driving adoption. Programs such as green building certifications (LEED, BREEAM) and carbon neutrality goals have made energy-efficient chillers a necessity rather than a luxury. The COVID-19 pandemic further underscored the importance of high indoor air quality, causing a shift in building design standards where HVAC systems play a critical role in maintaining healthy environments. Meanwhile, commercial and industrial sectors are expanding their footprint, increasing demand for scalable, modular cooling technologies such as scroll and absorption chillers.

However, the market also faces certain restraints. The high initial installation costs of absorption systems and the technical expertise required to integrate them into legacy HVAC infrastructure are major concerns for many end-users. Despite this, opportunities are growing, especially in district cooling projects, where centralized chiller plants offer cooling as a utility. The incorporation of AI-integrated smart HVAC systems for energy optimization, predictive maintenance, and performance analytics is further fueling market evolution.

AI’s Impact on the Scroll and Absorption Chillers Market

Artificial Intelligence is redefining HVAC operations by enabling smarter, self-regulating systems. In the scroll and absorption chillers segment, AI is improving system performance through predictive maintenance, which helps identify and address operational issues before they escalate. This not only reduces downtime but also extends the life cycle of the equipment. Moreover, AI-driven energy optimization algorithms fine-tune the chiller’s performance by analyzing usage patterns, ambient conditions, and occupancy levels.

In logistics and manufacturing, AI enhances supply chain efficiency, allowing OEMs and facility managers to plan maintenance schedules, manage parts inventory, and forecast demand. Integration with smart building systems further enhances the responsiveness and efficiency of chillers, enabling them to communicate with other building systems for seamless automation. For example, Carrier’s QuantumLeap™ suite, launched in February 2025, is specifically designed to support AI-powered operations in data centers. Similarly, LG’s July 2025 initiative in East Africa aims to equip AI data centers with next-gen HVAC systems.

In-Depth Segmentation Analysis

The market can be segmented across multiple categories based on technology, capacity, energy source, application, and end-user.

In terms of chiller type, scroll chillers dominate the market with a 58% share in 2024. These are popular in modular HVAC systems for commercial buildings, small-scale manufacturing units, and healthcare facilities. Absorption chillers, while still niche, are witnessing rapid growth due to their eco-friendly operation and suitability for industrial heat recovery. Hybrid systems that combine multiple chiller technologies are also gaining attention.

By cooling capacity, the 100–500 kW range represents the largest share (42%) in 2024, suitable for office buildings, hotels, and medium-sized commercial complexes. However, systems with >1,000 kW capacity are experiencing the fastest growth, driven by the rising need for cooling in data centers and district cooling networks.

For absorption chillers, energy source segmentation shows that steam-fired systems led the market in 2024 with a 36% share, largely due to their compatibility with industrial steam sources. The segment powered by exhaust or waste heat recovery is the fastest-growing, given the global shift toward circular energy solutions.

In terms of application, commercial buildings continue to be the largest segment (39%), while data centers are emerging as the fastest-growing vertical due to their round-the-clock cooling needs and stringent uptime requirements.

By end-user, HVAC contractors and EPC firms held the largest share (47%) as they manage large-scale project deployments. Meanwhile, Energy Service Companies (ESCOs) are expanding their footprint with turnkey solutions that promise performance-linked returns and long-term energy savings.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.08 Billion |

| Market Size in 2025 | USD 14.17 Billion |

| Market Size in 2024 | USD 13.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.51% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chiller Type, Cooling Capacity, Energy Source, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Landscape and Growth Highlights

Asia Pacific leads the global scroll and absorption chillers market with a commanding 45% share. This dominance is attributed to large-scale manufacturing, rapid urbanization, and supportive policies across countries like China, India, and Japan. India’s ICAP (India Cooling Action Plan) and China’s aggressive infrastructure investments have created a robust environment for chiller adoption.

The Middle East & Africa (MEA) region is witnessing the fastest growth, fueled by large-scale infrastructure projects such as NEOM and the Red Sea Project in Saudi Arabia. High ambient temperatures, combined with increased power demand, are driving investments in advanced cooling technologies. Government-led initiatives to promote solar HVAC systems and AI-integrated smart cities are further supporting market expansion.

In North America, growth is driven by green building standards, retrofit initiatives, and the presence of key players like Carrier, Johnson Controls, and Daikin. The focus on decarbonization is pushing adoption of energy-efficient systems in both new and existing infrastructure.

Europe is characterized by stringent energy regulations, making it a lucrative market for hybrid and absorption chillers. Government subsidies and carbon taxation are encouraging businesses to upgrade to greener technologies.

Latin America is an emerging market with increasing demand from the retail, hospitality, and healthcare sectors. Countries like Brazil and Mexico are seeing increased investments in smart urban infrastructure, indirectly fueling chiller adoption.

Read Also: Heme Protein Market Size, Share, Growth, Trends, and Forecast 2025–2034

Competitive Landscape and Industry Developments

The global scroll and absorption chillers market is consolidated among a few dominant players with strong innovation pipelines and global supply chains. Johnson Controls, Daikin Industries, Carrier Corporation, and Trane Inc. are leading the pack. Other notable players include Broad Air Conditioning, Yazaki Energy System, Thermax, Hitachi Appliances, Century Corporation, and Rohur Group.

Recent developments highlight the industry’s push toward AI, modularity, and localization. In February 2025, Carrier introduced its QuantumLeap™ platform to optimize data center cooling. Daikin presented its sustainable HVAC solutions at the AHR Expo 2025. Carrier India, in line with the “Make in India” movement, launched modular scroll chillers in May 2024. LG’s July 2025 strategy aims to cater to the growing demand for smart HVAC systems in African data centers.