Market Overview

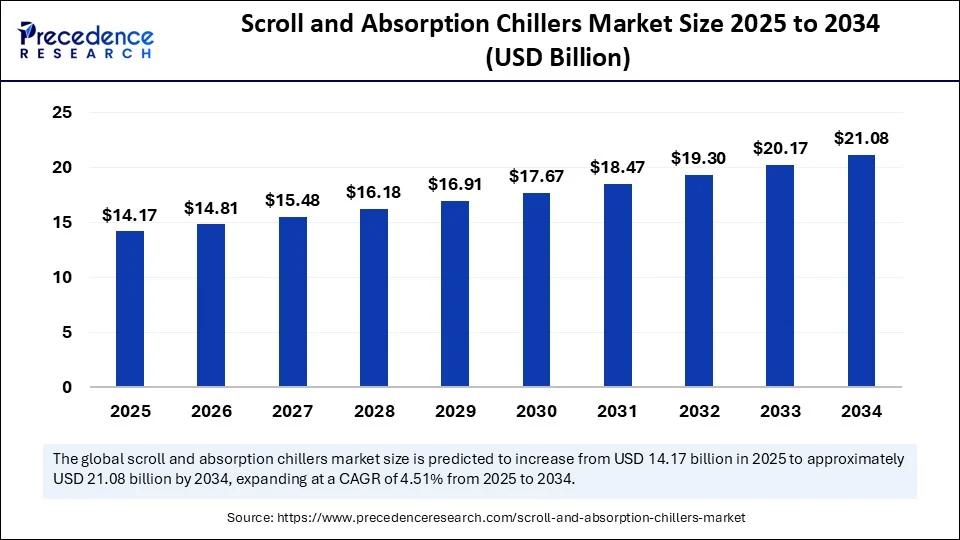

The global scroll and absorption chillers market was valued at USD 13.56 billion in 2024 and is projected to reach USD 21.08 billion by 2034, registering a CAGR of 4.51% over the forecast period. The rise in demand for cost-effective, eco-friendly cooling systems across various sectors, including commercial, industrial, and institutional, is significantly propelling market growth. These chillers form the backbone of modern energy-efficient HVAC systems, offering optimized cooling performance with reduced carbon emissions. As regulatory pressure to decarbonize increases, scroll and absorption chillers are becoming essential in new construction and retrofit projects worldwide.

Scroll and Absorption Chillers Market Key Points

- In terms of revenue, the global scroll and absorption chillers market was valued at USD 13.56 billion in 2024.

- It is projected to reach USD 21.08 billion by 2034.

- The market is expected to grow at a CAGR of 4.51% from 2025 to 2034.

- Asia Pacific dominated the global scroll and absorption chillers market with the largest share of 45% in 2024.

- The Middle East and Africa is expected to grow at a significant CAGR from 20245 to 2034.

- By chiller type, the scroll chillers segment captured the biggest market share of 58% in 2024.

- By chiller type, the absorption chillers segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By cooling capacity, the 100–500 kW segment contributed the highest market share of 42% in 2024.

- By cooling capacity, the >1,000 kW segment will grow at the fastest CAGR between 2025 and 2034.

- By energy source, the steam-fired segment generated the largest market share of 36% in 2024.

- By energy source, the exhaust/waste heat recovery segment will expand at a significant CAGR between 2025 and 2034.

- By application, the commercial buildings segment held the major market share of 39% in 2024.

- By application, the data centers segment is expected to grow at the highest CAGR between 2025 and 2034.

- By end-user, the HVAC contractors and EPC firms segment accounted for biggest market share of 47% in 2024.

- By end-user, the energy service companies (ESCOs) segment is expected to expand at a significant CAGR between 2025 and 2034.

Market Dynamics

Key Growth Drivers

The market is being fueled by a global push toward sustainability and energy conservation. Increased attention to indoor air quality especially in the wake of rising chronic health conditions—has placed greater emphasis on efficient ventilation and cooling technologies. Additionally, the deployment of smart chiller systems with real-time performance analytics is helping building operators meet stringent environmental standards while enhancing comfort and operational efficiency.

Market Restraints

Despite their benefits, high upfront installation costs remain a major obstacle, particularly for small- and mid-sized businesses. Moreover, absorption chillers, while energy-saving in the long run, are complex in design and demand highly skilled maintenance teams, hindering their adoption in some developing economies.

Emerging Opportunities

Advancements in district cooling systems, often deployed in urban hubs and institutional campuses, are creating lucrative openings for the market. Government-backed smart city projects are also integrating advanced HVAC solutions. Furthermore, the rise of AI-powered predictive maintenance is reshaping HVAC management by offering real-time diagnostics, minimizing downtime, and optimizing energy usage.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.08 Billion |

| Market Size in 2025 | USD 14.17 Billion |

| Market Size in 2024 | USD 13.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.51% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chiller Type, Cooling Capacity, Energy Source, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Chiller Type Analysis

In 2024, scroll chillers held a dominant 58% market share owing to their cost-efficiency, compact design, and low operational noise. These systems are a top choice for mid-sized commercial properties like hotels, office complexes, and hospitals. On the other hand, absorption chillers are projected to witness the fastest growth during the forecast period. These systems leverage waste heat or exhaust energy to provide cooling, aligning perfectly with green building goals and circular energy usage principles.

Cooling Capacity Analysis

The 100–500 kW capacity segment emerged as the market leader in 2024, accounting for 42% of the share. This range is ideal for commercial spaces requiring consistent, scalable cooling solutions. Meanwhile, chillers with capacities exceeding 1,000 kW are anticipated to grow rapidly, particularly in data centers and industrial production facilities, which demand robust and uninterrupted thermal regulation.

Energy Source Analysis (Absorption Chillers)

Among energy sources, steam-fired chillers held a 36% share in 2024, predominantly used in facilities with existing steam infrastructure. However, the waste heat recovery segment is expanding rapidly. Companies are increasingly integrating waste heat recovery systems into their HVAC design to meet sustainability mandates and reduce reliance on fossil fuels.

Application Insights

Commercial buildings led the market by application, capturing 39% share in 2024. This includes retail malls, airports, hospitals, and educational campuses where consistent cooling is essential. Meanwhile, the data center segment is expected to register the fastest growth, driven by increasing digitalization and rising heat loads from dense server infrastructure. Learn more through the related insights on the data center cooling market.

End-User Insights

HVAC contractors and EPC (Engineering, Procurement, and Construction) firms were the largest end-users in 2024, accounting for 47% of the market. These firms oversee system design, installation, and lifecycle management. In contrast, Energy Service Companies (ESCOs) are growing rapidly, offering full-scope HVAC upgrades under performance-based contracts. These firms are helping clients transition to high-efficiency systems through financing, retrofitting, and operational optimization.

Read Also: Sexually Transmitted Diseases Diagnostics Market Size to Surpass USD 21.44 Bn by 2034

Regional Analysis

Asia Pacific: Market Leader

The Asia Pacific region accounted for 45% of the global market in 2024, driven by government policies such as India’s Cooling Action Plan (ICAP) and China’s clean energy programs. Accelerated industrialization and commercial construction, especially in India, China, and Southeast Asia, are increasing the deployment of scroll and absorption chillers. Discover more about this regional trend in the Asia-Pacific Cooling Market.

Middle East & Africa: Fastest-Growing Region

This region is experiencing a surge in infrastructure investment, including futuristic projects like NEOM City in Saudi Arabia and the Red Sea Project. With strong government backing for solar-integrated HVAC systems, the Middle East & Africa region is quickly emerging as a hotbed for sustainable cooling technologies.

North America: Mature but Evolving

In North America, market growth is driven by adherence to green building standards such as LEED and WELL. The presence of leading chiller manufacturers, combined with increasing investments in smart HVAC systems, continues to support regional market expansion.

Role of AI in Chiller Optimization

Artificial Intelligence is playing a transformative role in modern chiller systems. Through predictive analytics, AI can forecast system failures, enabling preemptive repairs and replacements. It also facilitates real-time performance optimization, automatically adjusting system parameters to maintain ideal operating conditions. These capabilities lead to substantial reductions in operating and maintenance costs, while improving equipment reliability and extending service life.

Recent Developments

-

Carrier Global launched its QuantumLeap™ suite in February 2025, designed for ultra-efficient data center cooling.

-

At the 2025 AHR Expo, Daikin Applied Americas introduced a full portfolio of decarbonized HVAC solutions.

-

In May 2024, Carrier India unveiled the 30RB Modular Scroll Chiller, enhancing flexibility and energy savings.

-

LG Electronics, in July 2025, announced its focus on AI-integrated HVAC systems to cater to large-scale infrastructure.

Leading Market Players

-

Johnson Controls Inc.

-

Daikin Industries Ltd.

-

Carrier Corporation

-

Trane Inc.

-

Thermax Ltd.

-

Hitachi Appliances Inc.

-

Yazaki Energy System Inc.