In 2024, the global sterility testing market was valued at approximately USD 1.8 billion. It is projected to reach over USD 4.5 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.5% from 2025 to 2034. This robust expansion is primarily driven by the increase in sterile pharmaceutical and biologics production, the pressure to accelerate batch release timelines, and the integration of AI and automation technologies into microbiological testing frameworks. Rapid diagnostic solutions and real-time microbial detection systems are being rapidly adopted by pharmaceutical manufacturers to streamline operations and meet regulatory compliance.

Pharmaceutical Rapid Microbiology Testing Market Key Points

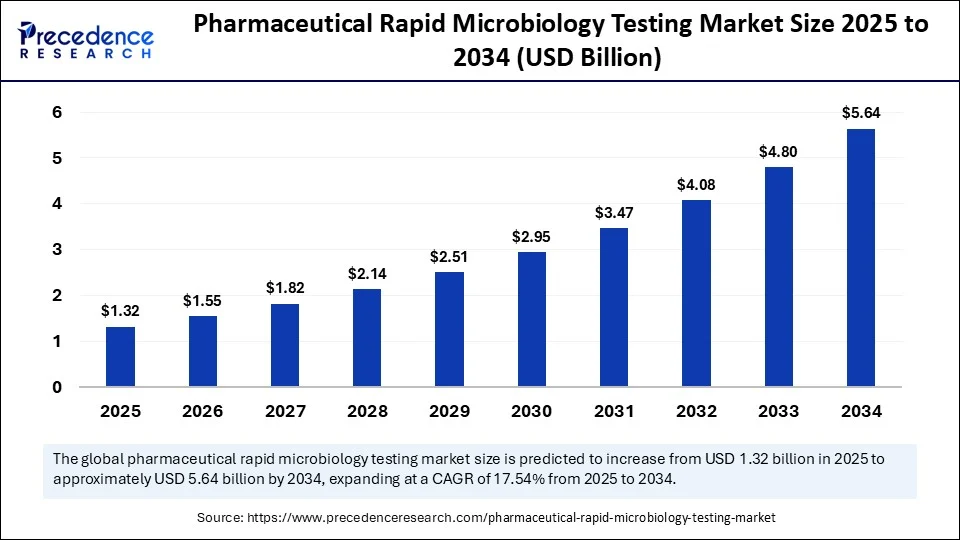

- In terms of revenue, the global pharmaceutical rapid microbiology testing market was valued at USD 1.12 billion in 2024.

- It is projected to reach USD 5.64 billion by 2034.

- The market is expected to grow at a CAGR of 17.54% from 2025 to 2034.

- North America dominated the pharmaceutical rapid microbiology testing market with the largest share of 38% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming years.

- By technology type, the polymerase chain reaction (PCR) segment held the biggest share in 2024.

- By technology type, the flow cytometry segment is observed to grow at the fastest CAGR during the forecast period.

- By product type, the instruments segment led the market in 2024.

- By product type, the software & services segment is expected to grow at the fastest CAGR in the coming years.

- By application, the biopharmaceuticals segment captured the highest market share in 2024.

- By application, the vaccines segment is emerging as the fastest-growing segment during the forecast period.

- By microorganism type tested, the bacterial segment generated the major market share in 2024.

- By microorganism type tested, the viruses segment is expected to expand at the fastest CAGR during the projection period.

- By end-user, the pharmaceutical and biotechnology companies segment held the significant market share in 2024.

- By end-user, the contract manufacturing organizations (CMOs) segment is observed to grow at the fastest CAGR during the forecast period.

- By testing type, the sterility testing segment accounted for major market share in 2024.

- By testing type, the environmental monitoring segment is emerging as the fastest-growing segment.

Get a Sample: https://www.precedenceresearch.com/sample/6332

Introduction

Sterility testing is a crucial process in pharmaceutical quality assurance, used to confirm the absence of viable contaminating microorganisms in products such as sterile drugs, biologics, and vaccines. It ensures patient safety by verifying the sterility of parenteral products and other injectables. As the pharmaceutical landscape evolves with advanced therapies like gene and cell treatments, the demand for reliable and faster sterility verification methods has surged. Traditional methods such as membrane filtration and direct inoculation are time-consuming and labor-intensive. The industry is now embracing next-generation sterility testing that leverages automation, real-time data monitoring, and digital platforms for rapid and more consistent results.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.64 Billion |

| Market Size in 2025 | USD 1.32 Billion |

| Market Size in 2024 | USD 1.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Product Type, Application, Microorganism Type Tested, End User, Testing Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

-

Rising Biologics & Personalized Therapies: The surge in gene therapy and monoclonal antibody production demands stringent microbial control.

-

Automated Cleanroom Monitoring: Pharma 4.0 initiatives are pushing the shift to real-time contamination detection systems.

-

Regulatory Pressure: Authorities like the FDA and EMA now expect faster and more accurate sterility assurance, fueling demand for modern tools.

Restraints

-

Legacy System Compatibility: Integrating AI-based testing platforms with old QC infrastructures remains a technical challenge.

-

Workforce Gap: There’s a global shortage of microbiology experts and trained data analysts capable of interpreting complex sterility datasets.

Opportunities

-

Emerging Market Expansion: Nations in Asia Pacific and Latin America are witnessing CMO growth, opening new testing demand.

-

AI-Driven Platforms: AI-powered sterility detection and predictive microbiology tools are reshaping quality management systems.

-

Point-of-Care Diagnostics: Portable sterility detection for hospitals and remote labs is gaining acceptance.

Regional Insights

-

North America: The United States dominates due to its advanced pharmaceutical industry, FDA-backed mandates for rapid testing, and leading sterility testing providers.

-

Asia Pacific: Countries like India, China, and South Korea are investing in CMOs and biosimilar production facilities. Government initiatives to modernize pharmaceutical QC labs are further driving adoption of next-gen sterility solutions.

Technology Insights

PCR (Polymerase Chain Reaction) and flow cytometry are currently at the forefront of rapid sterility testing. These technologies allow early-stage contamination detection without the need for traditional culturing. Bioluminescence-based ATP testing, impedance monitoring, and biosensors are becoming vital tools for culture-independent sterility assurance. These real-time detection techniques reduce testing time from 14 days to as few as 4–6 days, significantly accelerating product release cycles.

Application Outlook

Next-generation sterility testing is most prominently used in the biopharmaceutical sector, especially for monoclonal antibodies, vaccines, and advanced therapy medicinal products (ATMPs) such as CAR-T and gene therapies. Additionally, hospital pharmacy compounding units, clinical labs, and central diagnostic labs are beginning to adopt rapid sterility tools for critical applications such as parenteral preparations and immunotherapies.

Read Also: Lymphedema Diagnostics Market Size to Surpass USD 70.52 Million by 2034

End User Analysis

Pharmaceutical and biotechnology companies are the dominant users due to in-house QC requirements and regulatory mandates. However, contract manufacturing organizations (CMOs) are increasingly outsourcing microbial quality control, seeking scalable, validated, and fast-testing protocols that align with global compliance needs. This outsourcing trend is expected to fuel the demand for plug-and-play sterility testing solutions with remote monitoring capabilities.

Competitive Landscape

- Thermo Fisher Scientific Inc.

- Merck KGaA (MilliporeSigma)

- Bio-Rad Laboratories, Inc.

- Lonza Group AG

- Charles River Laboratories International, Inc.

- 3M Company

- Hamilton Company

- Microbiological Solutions (a part of Pall Corporation)

- Pall Corporation

- Pall Life Sciences

- Qiagen N.V.

- PerkinElmer, Inc.

- Eurofins Scientific

- IDEXX Laboratories, Inc.

- BioMérieux SA

- Neogen Corporation

- Agilent Technologies, Inc.

- Nova Biomedical Corporation

- LuminUltra Technologies Ltd.

- Accelerate Diagnostics, Inc.

Recent Developments

-

Nelson Labs introduced a validated 6-day rapid sterility testing protocol in early 2025, reducing batch release time and regulatory hold-ups.

-

Redberry’s novel 4-day sterility test was approved by regulatory bodies and is being adopted by global CMOs.

-

RID’s BSIDx, an AI-powered microbial diagnostic platform, received CE certification and is revolutionizing predictive sterility testing by enabling real-time alerts during production.