The global medical isotope production market plays a vital role in the rapidly advancing field of nuclear medicine. These isotopes are radioactive substances primarily used in diagnostic imaging, cancer treatment, and biomedical research. From identifying cancerous tissues via PET and SPECT scans to delivering targeted therapy in neuroendocrine tumors, medical isotopes are indispensable in modern healthcare systems. In 2024, the market was valued at USD 4.35 billion, and it is projected to reach USD 9.69 billion by 2034, growing at a CAGR of 8.34% during the forecast period. The steady growth is driven by increased demand for nuclear medicine procedures, AI-led innovations in production and logistics, and government-backed investments in isotope infrastructure.

For professionals exploring emerging markets in healthcare technology and diagnostics, it’s worth noting that related segments such as the Nuclear Medicine Market are also witnessing rapid expansion due to synergies with isotopic technologies.

Rising Demand: What’s Fueling Market Growth?

One of the primary factors driving growth in medical isotope production is the global increase in cancer incidence, which is projected to exceed 30 million new cases annually by 2030. Radiopharmaceuticals are used extensively in oncology for tumor detection, treatment response monitoring, and therapy planning. Moreover, isotopes such as Technetium-99m (Tc-99m) and Fluorine-18 (F-18) are instrumental in diagnostic imaging, especially for cancer, heart conditions, and neurological disorders.

An aging population globally is another key driver. With age, the risk of chronic diseases increases, which boosts the demand for diagnostic imaging procedures using isotopes. SPECT and PET scans, powered by Tc-99m and Ga-68 respectively, are becoming routine in cardiology, oncology, and neurology.

Governments worldwide, particularly in the United States, Canada, and India, are making significant investments to support isotope infrastructure. Initiatives by the U.S. Department of Energy (DOE) and the International Atomic Energy Agency (IAEA) are strengthening domestic production capacities and fostering innovation in the field.

Market Key Points

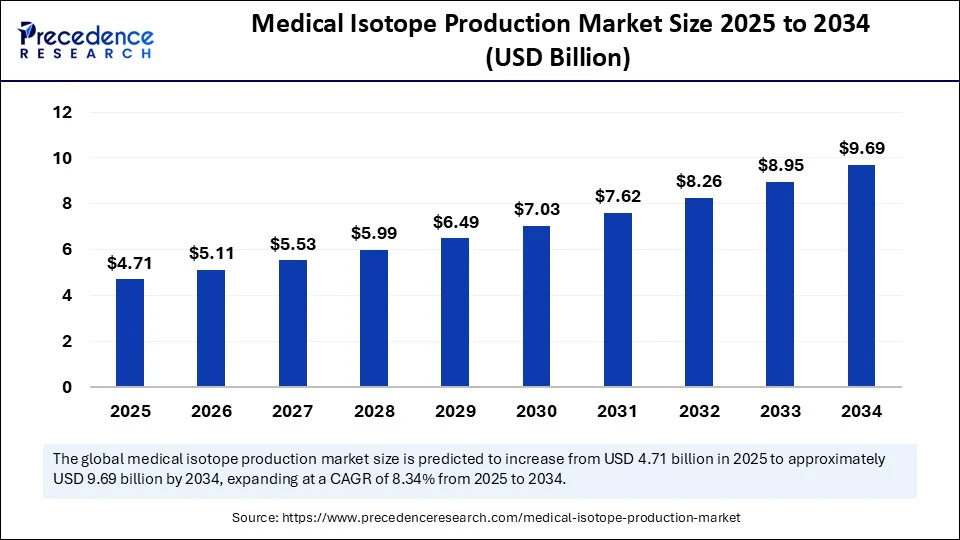

- In terms of revenue, the global medical isotope production market was valued at USD 4.35 billion in 2024.

- It is projected to reach USD 9.69 billion by 2034.

- The market is expected to grow at a CAGR of 8.34% from 2025 to 2034.

- North America dominated the medical isotope production market with the largest market share 58% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By isotope type, the diagnostic segment held the biggest market share of 70% in 2024.

- By isotope type, the therapeutic segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By production technology, the nuclear reactor-based production segment captured the highest market share of 65% in 2024.

- By production technology, the cyclotron-based production segment is expected to expand at a notable CAGR over the projected period.

- By application, the diagnostic segment generated the major market share of 45% in 2024.

- By application, the therapeutic segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospital and clinics segment accounted for largest market share of 55% in 2024.

- By end user, the pharma and biotech companies segment is expected to expand at a notable CAGR over the projected period.

Technology Trends: Reactor Dominance and Cyclotron Innovation

Traditionally, most medical isotopes have been produced using nuclear reactors. In 2024, reactor-based methods accounted for about 65% of global production, with isotopes like Molybdenum-99 (Mo-99), Iodine-131, and Lutetium-177 (Lu-177) dominating supply. These isotopes are essential in both high-volume diagnostics and targeted cancer therapies.

However, cyclotron-based production technologies are gaining traction, especially for producing short-lived isotopes like F-18 and Ga-68, which are used in PET imaging. These technologies allow on-site or regional production, significantly reducing decay losses and logistical issues.

Excitingly, AI is revolutionizing production modeling and process optimization. In 2025, Oak Ridge National Laboratory and Vanderbilt University introduced machine learning algorithms that optimize Actinium-225 production—a highly sought-after isotope in targeted alpha therapy. Meanwhile, Astral Systems unveiled compact fusion-based isotope generators, enabling decentralized, clean production methods. Neural networks are also being trained to predict nuclear cross-sections for precise output, cutting trial-and-error cycles in isotope manufacturing.

AI in Supply Chain and Theranostics

In mid-2025, new AI-powered solutions began optimizing the entire medical isotope supply chain. AI platforms now analyze isotopic decay rates and transportation timelines to create predictive delivery models that ensure minimal waste and maximum efficacy. This is crucial given the short half-lives of many isotopes like F-18.

AI is also enabling on-site micro-production units at hospitals and diagnostic centers. These systems use real-time data to calibrate production runs based on daily demand, improving operational efficiency and reducing dependence on centralized facilities.

Importantly, AI is catalyzing the rise of theranostics, where the same molecule is used for both diagnosis and treatment. By simulating patient-specific tumor interactions with isotopes like Lu-177 or Actinium-225, AI tools are helping design highly targeted, personalized cancer treatments.

Regional Insights: Leaders and Emerging Frontiers

North America

North America remains the largest regional market, commanding approximately 58% share in 2024. The U.S. alone performs over 20 million nuclear medicine procedures each year. Companies such as SHINE Technologies, NorthStar Medical Radioisotopes, and BWX Technologies are innovating in fusion and accelerator-based isotope production. Canada’s Bruce Power and Darlington reactors are also expanding Mo-99 production capacity, helping to secure global supply chains.

Europe

Europe is investing heavily in future-ready infrastructure. The €2 billion PALLAS reactor project in the Netherlands is expected to go live by 2030 and will help offset isotope shortages caused by the planned shutdown of the HFR Petten reactor. European demand is particularly high for isotopes used in neuroendocrine cancer treatments, including Lu-177 and Ga-68.

Asia-Pacific

Asia-Pacific is the fastest-growing region in this market. India’s Bhabha Atomic Research Centre (BARC) operates 24 cyclotrons across the country, and their focus on isotopes like Ga-68 and Lu-177 is helping localize production. In China, the Three-Year Action Plan for Nuclear Medicine is driving the development of domestic isotope capabilities to support the country’s increasing cancer burden. Australia, South Korea, and Japan are also investing in scalable, AI-integrated cyclotron systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.69 Billion |

| Market Size in 2025 | USD 4.71 Billion |

| Market Size in 2024 | USD 4.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.34% |

| Dominating Region | North America |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Isotope Type, Production Technology, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation Breakdown

By Isotope Type

Diagnostic isotopes dominate the market with over 70% share. Tc-99m remains the gold standard for SPECT scans, while F-18 and Ga-68 are becoming essential in PET imaging, particularly in neurology.

Therapeutic isotopes, while a smaller share today, represent the fastest-growing segment. Lu-177 and I-131 are widely used in treating neuroendocrine tumors, prostate cancer, and thyroid disorders. New entrants like Actinium-225 and Yttrium-90 are also gaining clinical acceptance for their high precision and low toxicity.

By Production Technology

Reactor-based technology is ideal for large-scale production and high-volume isotopes. However, cyclotron-based technology is gaining traction due to its flexibility and lower decay losses, especially for isotopes that need to be used within hours of production.

By Application

Diagnostic applications command 45% of the market, led by oncology. Neurology is rapidly catching up due to the increasing prevalence of Alzheimer’s and Parkinson’s disease. Therapeutic applications are growing in tandem, especially in the treatment of prostate and thyroid cancers. Research applications are robust in pharmaceutical development and academic studies, particularly in preclinical imaging and R&D.

By End User

Hospitals and clinics hold the largest share at 55%, as they are the primary sites for nuclear medicine procedures. However, pharmaceutical and biotech firms are the fastest-growing end-users, driven by the boom in radiopharmaceutical R&D, personalized medicine, and theranostic solutions.

Read Aldo: Automatic Labeling Machine Market Size to Reach USD 4.39 Billion by 2034

Market Challenges and Constraints

Despite the strong growth outlook, the market faces notable challenges. Regulatory delays in licensing new facilities—particularly from the U.S. Nuclear Regulatory Commission (NRC)—can slow down time-to-market. The IAEA has also highlighted the slow global adoption of non-reactor-based production methods, which are more sustainable and decentralized.

Moreover, logistics remain a critical pain point. Isotopes like Tc-99m and F-18 degrade quickly, requiring rapid and carefully controlled transport. Inadequate storage or transit delays can lead to high wastage and cost overruns, particularly in low-infrastructure settings.

Emerging Opportunities in a Dynamic Market

The expansion of global theranostics is creating vast new opportunities. FDA approvals for Lu-177–based radiopharmaceuticals are paving the way for widespread adoption. India is also rapidly expanding Lu-177 and Ga-68 production capacity through public-private partnerships and academic collaborations.

There is also a growing trend of strategic partnerships between pharmaceutical companies, contract manufacturing organizations (CMOs), and research institutions to accelerate innovation. These collaborations are essential for reducing costs, improving accessibility, and scaling isotope production in underserved regions.

For more on precision medicine opportunities, explore our research on the Radiopharmaceuticals Market.

Competitive Landscape: Key Players and Investments

The competitive landscape is dynamic, with legacy manufacturers and startups alike competing on innovation, reliability, and scalability. Key players include:

- SHINE Technologies – pioneering fusion-based Mo-99 production.

- NorthStar Medical Radioisotopes – commercializing non-reactor isotope production.

- BWX Technologies – expanding U.S. Lu-177 supply.

- Curium, IRE, Cardinal Health – global distribution and logistics powerhouses.

- GE Healthcare, Siemens (PETNET) – integrating imaging platforms with isotope solutions.

- Novartis (Advanced Accelerator Applications) – leaders in theranostics.

- ITM Isotopen Technologien München, Isotopia, ANSTO – key global suppliers.

Recent Developments (2024–2025)

- Bruce Power (Canada): Invested CAD 22 million in Mo-99 production infrastructure.

- Darlington Unit 1: Became the first power reactor globally to produce commercial Mo-99.

- Nusano (Utah, USA): Launched a new rare isotope facility in January 2025.

- Nuclearelectrica (Romania): Partnered to produce Lu-177 at the Cernavodă reactor, bolstering EU supply.

Conclusion: Radiating Opportunity in Healthcare

The medical isotope production market is at the cusp of a transformation, driven by technological convergence, AI-powered efficiencies, regulatory shifts, and rising clinical demand. With a projected valuation of USD 9.69 billion by 2034, the market offers substantial growth opportunities for investors, hospitals, biotech firms, and radiopharmaceutical developers.

As precision medicine becomes mainstream and theranostics reshape oncology treatment models, the strategic importance of reliable, scalable, and sustainable isotope production cannot be overstated.

To explore in-depth data and regional insights, visit Precedence Research’s Medical Isotope Production Market Report.