How Big Is the Lymphedema Treatment Devices Market and Where Is It Headed?

The lymphedema treatment devices market was valued at USD 740 million in 2024 and is projected to reach USD 1.92 billion by 2034, growing at a CAGR of 10.1% during the forecast period. This growth is fueled by increasing cancer survivorship, aging populations, and a rising trend of remote healthcare. Year-on-year market progression indicates that while initial growth is steady, a marked acceleration is expected after 2027 due to increased reimbursement coverage and broader adoption of wearable and AI-integrated devices. These trends signal a shift toward more proactive and technologically enhanced lymphedema management strategies.

What Are Lymphedema Treatment Devices and Why Are They Vital?

Lymphedema treatment devices are designed to manage and reduce swelling caused by lymphatic obstruction or damage, which commonly results from cancer treatments, surgeries, or inherited conditions. These devices play a crucial role in preventing chronic inflammation, fibrosis, and infection. Standard treatment devices include pneumatic compression pumps, compression garments such as sleeves and wraps, and newer wearable technologies. As awareness around lymphatic disorders increases, particularly among cancer survivors, the use of these treatment devices has seen a notable rise. Moreover, early diagnosis and the need for effective home-based care are driving significant demand for these solutions worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/6331

What Factors Are Driving the Growth of the Market?

One of the primary drivers of this market is the rising prevalence of cancer-related lymphedema. Post-treatment lymphedema is a common side effect of surgeries involving lymph node removal or radiation, especially in breast, prostate, and gynecologic cancers. As survivorship increases globally, long-term care solutions such as compression devices are becoming essential. Additionally, pneumatic compression devices and wearable compression garments are gaining traction due to their ease of use and improved clinical outcomes. The integration of artificial intelligence and Internet of Things (IoT) capabilities into these devices is also driving demand, enabling patients to receive personalized care and real-time monitoring from the comfort of their homes.

What Challenges Could Restrain Market Expansion?

Despite the market’s robust growth, several barriers persist. High costs of advanced lymphedema treatment systems, especially those with multi-chamber functionality and smart sensors, limit their accessibility, particularly in low-income regions. Patient adherence remains a concern as consistent, long-term use of compression devices can be uncomfortable and time-consuming. Moreover, in developing countries, awareness of lymphedema and its treatment options remains low, further hindering adoption. These limitations underscore the need for more affordable, patient-friendly devices and increased educational initiatives about lymphedema care.

Where Do the Market Opportunities Lie?

Significant opportunities are emerging with expanding insurance coverage and reimbursement frameworks. For instance, in the U.S., recent updates to Medicare coverage have included at-home pneumatic compression systems, which encourages wider use. The growing integration of telehealth services with treatment devices is another major opportunity. As more patients engage with digital health platforms, the demand for remotely monitored, app-connected devices is increasing. Additionally, ongoing R&D into smart wearables and real-time lymphatic monitoring technology presents vast potential for innovation, especially in developing soft robotic sleeves and intelligent compression textiles that can adapt therapy based on patient conditions.

Which Types of Devices Are Gaining Popularity?

Pneumatic compression pumps are widely recognized for their ability to effectively reduce fluid buildup and are considered the standard of care. These pumps often feature programmable cycles and segmented chambers to deliver customized therapy. Compression garments—including stockings, sleeves, and wraps—continue to serve as cost-effective first-line interventions, with innovations focused on enhancing comfort and compliance. Multi-chambered devices offer sequential pressure zones for advanced therapy, while portable and wearable options are quickly gaining ground for their convenience and applicability in home healthcare. Although still niche, surgical implants for lymphatic drainage are being explored in complex cases and may complement non-invasive therapies in the future.

What Are the Key Application Areas for These Devices?

Lymphedema treatment devices serve a broad range of applications. Primary lymphedema, often genetically inherited, typically requires lifelong management, and early diagnosis is driving demand among younger patients. Secondary lymphedema—resulting from trauma, infection, or surgical procedures—responds well to compression therapy, especially when treatment begins promptly. Cancer-related lymphedema remains a significant driver, particularly among breast cancer survivors. Devices are also essential in post-surgical management beyond oncology, including orthopedic and vascular surgeries, where swelling management is vital for recovery and mobility.

Who Are the Main End Users of Lymphedema Treatment Devices?

Hospitals and clinics represent a key end-user segment due to their use of sophisticated, high-performance compression systems. They are also the primary settings for diagnosis and initial therapy initiation. However, the most dynamic growth is occurring in the home healthcare segment, where patients prefer the convenience of self-administered, wearable, and portable devices. Specialized lymphedema treatment centers and rehabilitation clinics also play a vital role, often providing a mix of manual lymph drainage (MLD) and device-based therapy for holistic care. The rise of decentralized care models is pushing manufacturers to develop more user-friendly and compact device options suitable for non-clinical environments.

How Do Regional Markets Compare in Terms of Growth and Adoption?

North America is currently the largest market, with the U.S. leading in product approvals, reimbursement frameworks, and clinical integration of advanced treatment solutions. Europe follows closely, with established clinical guidelines and widespread use of early intervention protocols, especially in countries like Germany and the U.K. Meanwhile, Asia Pacific is projected to be the fastest-growing region, driven by rising healthcare awareness, increasing cancer rates, and improving infrastructure in countries such as India, China, and South Korea. Latin America and the Middle East & Africa are also emerging markets where access is being boosted through public-private partnerships and awareness campaigns, particularly in Brazil and South Africa.

Market scope

| Report Coverage | Details |

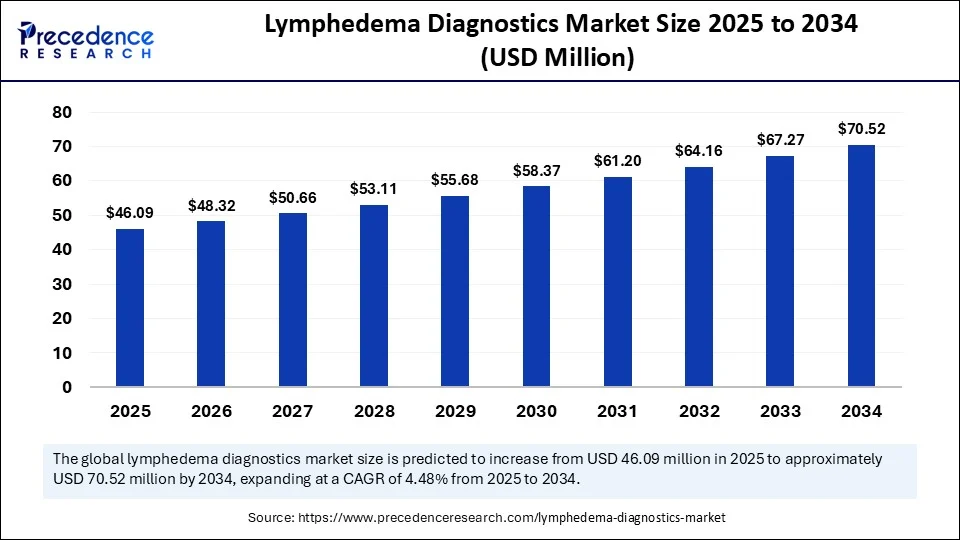

| Market Size by 2034 | USD 70.52 Million |

| Market Size in 2025 | USD 46.09 Million |

| Market Size in 2024 | USD 43.96 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Diagnostic Technology, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

How Is Technology Revolutionizing Lymphedema Care?

Technological advancements are reshaping the lymphedema treatment landscape. Artificial intelligence is being used to develop personalized therapy protocols that adapt based on a patient’s response and symptom progression. Smart sensors embedded in garments and sleeves monitor limb circumference, fluid movement, and device adherence. These sensors can transmit data to mobile apps or cloud platforms, enabling physicians to track progress remotely and adjust treatment accordingly. Such innovations not only enhance therapeutic effectiveness but also improve patient compliance and satisfaction. Remote care models are particularly valuable for patients in rural or underserved areas, who can now access expert care without repeated clinic visits.

Who Are the Key Players and What Strategies Are They Adopting?

The competitive landscape features both established medical device firms and specialized lymphedema care companies. Tactile Medical leads with its Flexitouch systems and strong clinical backing. Bio Compression Systems offers FDA-approved segmented devices that are popular in clinical settings. AIROS Medical is focusing on affordability and user-friendliness in its compression pumps. Other significant players include Lympha Press, Devon Medical Products, Cardinal Health, and BOA Tech. Companies are increasingly investing in R&D, wearable technology, and strategic partnerships. Recent FDA approvals, regional expansions, and mergers reflect a consolidating but innovation-driven market landscape.

What Recent Developments Are Shaping the Market?

Several key developments have marked 2024 and 2025. Tactile Medical launched Flexitouch Pro in June 2025, integrating AI feedback and app control. In May 2025, AIROS Medical raised $18 million in Series B funding to expand its remote therapy solutions. Bio Compression received FDA clearance for its Multi-Mini wearable system in early 2025, emphasizing portability and smart control. The European Union also updated its clinical guidelines in late 2024, recommending early device use for breast cancer patients to prevent secondary lymphedema. These developments underscore a broader trend toward digital, decentralized, and patient-centered lymphedema care.

What Does the Future Hold for the Lymphedema Devices Market?

The outlook for the lymphedema treatment devices market is robust, with technology-driven innovation, expanding insurance frameworks, and a growing global awareness pushing growth forward. As healthcare systems shift toward preventative and personalized care, the role of smart, connected compression devices is expected to become even more prominent. Companies that invest in user-friendly, AI-enabled, and affordable solutions will be best positioned to lead the market. Ultimately, the integration of early diagnosis, digital monitoring, and home-based therapy will redefine how lymphedema is managed worldwide—ushering in a new era of efficient, accessible, and intelligent care through 2034

Read Also: Aerospace Foam Market Set to Surpass USD 12.78 Billion by 2034

Lymphedema Diagnostics Market Companies

- Ambra Health

- Dr. Scholl’s (under diagnostic aids)

- GE Healthcare

- Hologic, Inc.

- ImpediMed Limited

- LymphaTech

- Medtronic – LINQ™ (implantable diagnostics adjunct)

- Medtronic plc

- Micropos Medical

- Natus Medical Incorporated

- NIRx Medical Technologies

- Perometer (CardioMed Devices)

- Philips Healthcare

- Qosina Corporation

- Siemens Healthineers

- SonoSite (Fujifilm)

- Stryker Corporation

- Tactile Medical

- Venosafe (Pico Technology)

- Evalution Medical

Recent Developments

- In January 2024, Medicare introduced a new Medicare benefit category covering lymphedema compression therapy supplies. This category includes a range of items, such as daytime and nighttime garments, adjustable wraps, and bandages, intended to support patients with varying forms of lymphedema across different body regions.

- In April 2023, AIROS Medical, Inc., a U.S.-based medical technology company, announced that it received FDA 510(k) clearance to market its AIROS 8P Sequential Compression Therapy device and garment system for lymphedema treatment. The clearance includes approval for expanded garment options such as lower truncal devices used to treat abdominal swelling. The AIROS 8P system is designed to enhance patient care by delivering clinically effective, non-invasive compression therapy in both clinical and home settings.

Latest Announcement by Industry Leader

- In June 2025, Tactile Systems Technology, Inc., a medical technology company specializing in therapies for chronic conditions, presented promising new clinical data at the American Society of Clinical Oncology (ASCO) 2025 Annual Meeting. The findings highlight significant clinical and quality-of-life benefits associated with the Company’s Flexitouch Plus system compared to standard care in patients suffering from head and neck cancer-related lymphedema. The study, led by Dr. Barbara Murphy, Professor of Medicine and Director of the Head and Neck Research Program at Vanderbilt-Ingram Cancer Center, revealed that patients using Flexitouch Plus experienced reduced swelling, faster initiation of therapy, and improved quality-of-life outcomes. Dr. Murphy noted that traditional care approaches—such as therapist-guided treatments and self-managed home care—often face accessibility challenges, delaying critical therapy for many patients. “These access limitations mean many patients either go untreated or start treatment too late,” said Dr. Murphy. “Our research supports the role of advanced pneumatic compression systems as a viable, scalable solution that enhances patient outcomes and streamlines care delivery.” The results further reinforce the clinical value of innovative, home-based lymphedema management technologies, particularly in oncology rehabilitation pathways where early intervention remains critical.

Segments Covered in the Report

By Diagnostic Technology

- Imaging Techniques

- Lymphoscintigraphy

- Magnetic Resonance Lymphangiography (MRL)

- Computed Tomography (CT) Lymphangiography

- Ultrasound Imaging

- Near-Infrared Fluorescence (NIRF) Imaging

- Bioimpedance Spectroscopy (BIS)

- Circumferential Measurement Tools

- Tape Measures

- Perometers

- Other Diagnostic Tools

- Tissue Dielectric Constant (TDC) measurement devices

- Tonometry

By Application

- Primary Lymphedema Diagnosis

- Secondary Lymphedema Diagnosis

- Post-Surgical Monitoring

- Therapeutic Effectiveness Monitoring

By End-User

- Hospitals and Clinics

- Diagnostic Laboratories

- Specialized Lymphedema Treatment Centers

- Ambulatory Care Centers

- Home Healthcare Providers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa