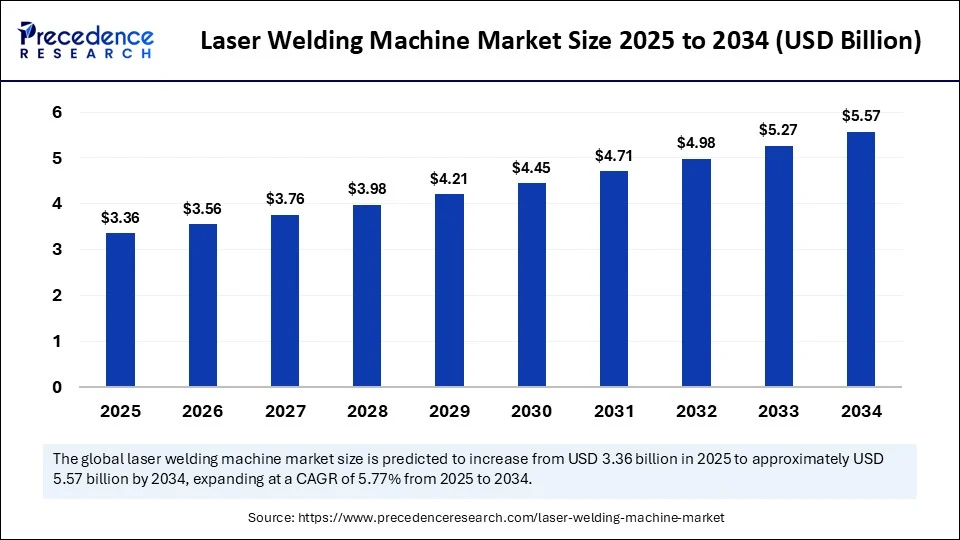

The global laser welding machine market size reached USD 3.18 billion in 2024 and is projected to be worth around USD 5.57 billion by 2034, at a CAGR of 5.77% from 2025 to 2034.

Laser welding is revolutionizing industrial manufacturing by enabling extremely precise and clean joining of metals and thermoplastics. The process utilizes a high-energy laser beam to melt and fuse materials, ensuring minimal heat-affected zones, reduced distortion, and high-speed operations. These capabilities make laser welding ideal for sectors requiring exact tolerances—such as automotive, aerospace, electronics, and medical devices.

Laser Welding Machine Market Key Points

- In terms of revenue, the global laser welding machine market was valued at USD 3.18 billion in 2024.

- It is projected to reach USD 5.57 billion by 2034.

- The market is expected to grow at a CAGR of 5.77% from 2025 to 2034

- Asia Pacific dominated the market with the largest share in 2024 and is expected to sustain its growth trajectory from 2025 to 2034.

- By laser type, the fiber laser segment held a major market share in 2024 and is projected to grow at a significant CAGR between 2025 and 2034.

- By operation mode, the automatic segment contributed the biggest market share in 2024.

- By technology, the keyhole welding segment dominated the market in 2024.

- By technology, the hybrid welding segment is expected to grow at a significant CAGR over the projected period.

- By application, seam welding segment dominated the market with the largest share in 2024.

- By application, hybrid welding segment is expected to grow at a significant CAGR from 2025 to 2034.

- By end-use industry, the automotive segment held the largest market share in 2024.

- By end-use industry, the electronics & semiconductor segment is projected to grow at the highest CAGR between 2025 and 2034.

- By power output, the 1 kW to 5 kW segment held a major market share in 2024.

- By power output, the above 5 kW segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By machine type, the robotic laser welding segment contributed the biggest market share in 2024.

- By machine type, the handheld laser welding segment is expanding at a significant CAGR between 2025 and 2034.

- By sales channel, the direct sales (OEM) segment dominated the market in 2024.

- By sales channel, the online platforms segment is expected to grow at a significant CAGR over the projected period.

What’s Driving the Spark? Key Market Growth Drivers

1. Automation in EV and Electronics Manufacturing

One of the most significant drivers is the rapid adoption of automation in the manufacturing of electric vehicles and consumer electronics. These industries demand precise welding techniques for intricate components like battery cells, sensors, and microelectronic parts. Laser welding is ideal for these applications due to its non-contact, high-accuracy capabilities. As the EV market surges, so does the need for welding solutions that can handle aluminum, copper, and high-strength steel.

2. AI and IoT Integration for Precision and Maintenance

Artificial intelligence and the Internet of Things (IoT) are redefining how welding systems operate. Modern laser welding machines are embedded with smart sensors and software that monitor weld quality, temperature, material behavior, and more. This data-driven approach facilitates predictive maintenance, reduces human error, and ensures consistent, high-quality output. Manufacturers can now achieve near-zero defect rates while increasing throughput and operational efficiency.

3. Export-Oriented Industrial Growth in Asia-Pacific and Beyond

Countries in Asia—particularly China, India, Vietnam, and South Korea—are becoming global export hubs for automotive parts, consumer electronics, and industrial machinery. These regions are investing heavily in high-precision manufacturing infrastructure, creating massive demand for laser welding solutions. Additionally, government initiatives like China’s “Made in China 2025” and India’s “PLI schemes” are accelerating the adoption of automated and AI-powered welding technologies.

A Laser Beam of Innovation: The Role of AI in Modern Welding

Artificial intelligence has transitioned from a buzzword to a critical enabler of precision welding. AI-powered laser welding machines now use computer vision systems that detect microscopic inconsistencies in weld joints, allowing machines to make instant adjustments. Machine learning algorithms analyze vast datasets in real time to ensure seamless, adaptive welding.

For example, Bodor’s ECO Series, launched in 2025, is a prime example of AI-integrated laser welding innovation. This series features energy-efficient systems with automated error detection and real-time optimization. Similarly, Emerson’s Branson GLX-1, launched in 2024, introduced a compact laser welder designed for automotive and small-part manufacturing that delivers consistent, high-speed welding with minimal operator intervention.

As we move deeper into the Industry 4.0 era, such systems are no longer optional—they are essential to remain competitive.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.57 Billion |

| Market Size in 2025 | USD 3.36 Billion |

| Market Size in 2024 | USD 3.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.77% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Laser Type, Operation Mode, Technology, Application, End-Use Industry, Power Output, Machine Type, Sales Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Analysis: Who’s Leading the Charge?

By Laser Type

Fiber lasers dominate the market due to their efficiency, low maintenance, and ability to weld a variety of metals with minimal thermal damage. Their high beam quality and power density make them suitable for high-speed, high-precision applications. Solid-state and CO₂ lasers continue to be used in niche areas but are being rapidly replaced by fiber systems.

By Operation Mode

Fully automatic laser welding systems are preferred in mass production environments such as automotive assembly lines, where consistency and speed are critical. Semi-automatic and manual systems remain popular among small and mid-sized enterprises (SMEs) and custom fabrication units due to lower capital investment requirements.

By Welding Technology

Keyhole welding, which uses deep-penetrating laser beams, is favored for thick materials and is widely used in heavy industries and aerospace. Hybrid laser welding, combining arc and laser techniques, is gaining traction for its ability to handle complex geometries and mixed materials, especially in high-end aerospace and structural applications.

By Application

Laser welding is integral to EV battery seam welding, powertrain components, lightweight vehicle structures, and electronic sensor assemblies. Hybrid welding systems are increasingly used in aerospace and defense due to their strength-to-weight benefits and precise bonding characteristics.

By End-Use Industry

The automotive industry holds the largest share, driven by demand for EV production and lightweight materials. The electronics and semiconductor segment is expected to witness the highest CAGR as devices become smaller, thinner, and more intricate.

By Power Output

Systems with 1–5 kW output are most commonly used in battery packs, microelectronics, and light industrial applications. Demand for >5 kW systems is growing in aerospace, shipbuilding, and structural steel fabrication where deeper penetration and higher strength are essential.

By Machine Type

Robotic laser welding machines dominate the market due to their ability to execute complex welds with minimal human involvement. These are widely used in high-volume production. Handheld laser welders, while smaller, are growing in adoption among SMEs for their flexibility, affordability, and ease of training.

By Sales Channel

Direct sales to OEMs remain the primary channel, ensuring custom installations and service support. However, online industrial platforms are gaining popularity, especially for standardized, plug-and-play systems aimed at global markets.

Read Also: Wearable Air Quality Monitoring System Market Size, Forecast by 2034

Asia-Pacific: The New Welding Capital?

The Asia-Pacific region has rapidly become the epicenter of global laser welding innovation. With robust industrial policies, abundant skilled labor, and exponential growth in EV and semiconductor production, APAC is expected to remain the fastest-growing region throughout the forecast period.

China is investing heavily in smart factories and AI-powered machinery. Japan and South Korea are leading in semiconductor welding applications, while India is emerging as a promising market with increased localization in electronics manufacturing.

Reports from VDMA and the International Institute of Welding (IIW) confirm that APAC countries have the highest robotic welder adoption rates globally, underpinned by government subsidies and R&D funding for automation technologies.

Challenges and Barriers to Entry

Despite rapid growth, several challenges could inhibit market adoption:

-

High capital investment continues to be a barrier for SMEs, especially in developing economies.

-

The complexity of system operation and programming necessitates skilled operators and training resources.

-

Safety regulations and industry standards compliance can vary across regions, making global scaling difficult for new entrants.

Moreover, integrating AI into traditional manufacturing environments often requires retrofitting infrastructure and digital transformation, which adds to operational costs.

Opportunities on the Horizon

The future of laser welding presents immense potential across industries:

Micro-Welding in Medical Devices

The rise of miniaturized surgical instruments, implants, and diagnostic devices calls for ultra-precise, contamination-free welding. Laser welding ensures sterile, accurate, and repeatable joints without compromising structural integrity.

Smart Software Integration

Next-gen laser welding systems are being equipped with AI-based control software, remote monitoring dashboards, and real-time data analytics, enabling seamless integration into digital manufacturing ecosystems.

Fiber Laser Upgrades

Advancements in high-power, multi-mode fiber lasers are enabling deeper, faster welds, enhancing productivity while maintaining energy efficiency. This is particularly relevant in industries like aerospace and shipbuilding.

Competitive Landscape

The laser welding machine market is highly competitive and innovation-driven. Major players include:

-

TRUMPF GmbH + Co. KG

-

IPG Photonics Corporation

-

Han’s Laser Technology Industry Group Co.

-

Coherent Corp.

-

Emerson Electric Co.

-

Panasonic Corporation

-

FANUC Corporation

-

Bodor Laser