Introduction: What Are Heme Proteins and Why Do They Matter?

Heme proteins are a specialized group of metalloproteins characterized by the presence of a heme prosthetic group—an iron-containing porphyrin ring essential for electron transfer, oxygen transport, and enzymatic reactions. These proteins play a pivotal role in various biological functions including cellular respiration, redox signaling, and oxygen binding. With growing interest in metabolic engineering, pharmaceutical innovation, and food technology, heme proteins are becoming integral to both health sciences and industrial biotechnology.

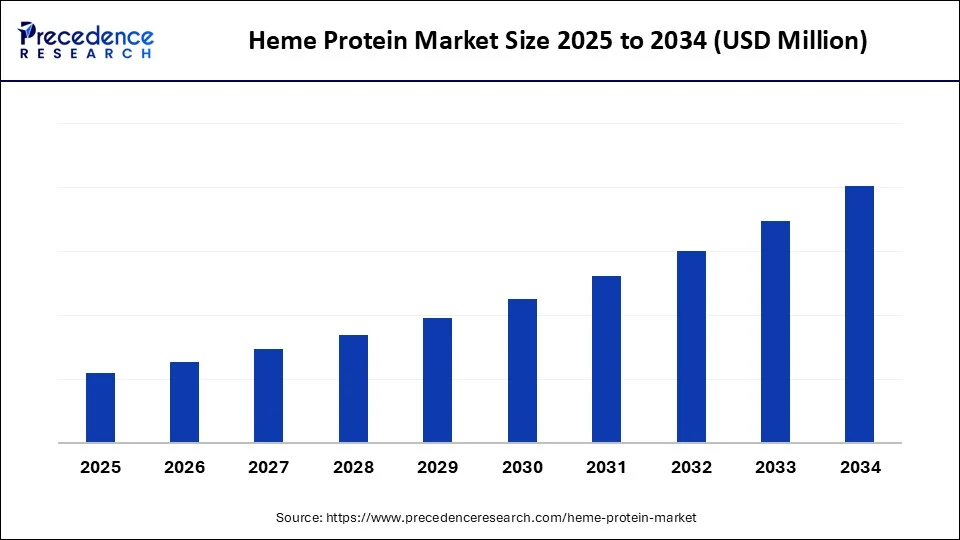

The global heme protein market is poised for substantial growth from 2025 to 2034, fueled by advancements in biotechnology, synthetic biology, and recombinant protein manufacturing. Industries such as pharmaceuticals, food and beverage, and environmental testing are increasingly integrating heme-based solutions to enhance product performance and functionality. Moreover, the rising demand for plant-based meat alternatives and clean-label products is creating a favorable environment for heme protein innovation, especially through fermentation-driven recombinant production.

Get a Sample: https://www.precedenceresearch.com/sample/6386

Key Market Points

| Key Metrics | Highlights |

|---|---|

| Market Share (2024) | North America led with 39% market share |

| Fastest-Growing Region | Asia Pacific, led by China and India’s alt-meat and biotech ecosystems |

| By Protein Type | Hemoglobin (35%) dominated; Cytochrome P450 growing rapidly |

| By Source | Animal-based (60%) led; recombinant heme gaining traction |

| By Application | Pharmaceuticals & Drug Discovery (40%) dominated; food tech rising |

| By End-User | Pharma & Biotech firms (50%) led; F&B companies expanding their adoption |

The Expanding Role of AI in Heme Protein Engineering

Artificial Intelligence (AI) is revolutionizing the production and analysis of heme proteins. AI-powered platforms are now used to model protein structures, design heme-binding sites, and optimize microbial strains for fermentation. These tools drastically reduce R&D timelines by predicting metabolic outcomes and streamlining gene-editing workflows. In the context of recombinant protein production, AI aids in precision fermentation and improves protein yield while maintaining purity standards.

Moreover, AI applications extend to downstream processing and quality control, ensuring batch consistency for pharmaceutical-grade heme proteins. In clinical diagnostics, AI supports the development of biosensors and enzyme-linked immunoassays that incorporate heme proteins such as peroxidases and cytochrome c. From personalized medicine to advanced food processing, AI is helping decode and deliver the full potential of heme biology.

Market Dynamics: What’s Driving Growth?

The heme protein market is experiencing rapid expansion due to several intersecting factors. One major driver is the rising demand for plant-based meat products that replicate the sensory experience of animal-derived meat. Heme, particularly soy leghemoglobin, contributes the characteristic color, flavor, and aroma that appeal to flexitarian and vegan consumers. Companies like Impossible Foods have leveraged heme proteins to transform the meat alternative industry.

Another strong catalyst is the evolution of synthetic biology, which enables scalable production of heme proteins via genetically engineered microorganisms. This approach provides a clean, animal-free solution that aligns with sustainability and ethical sourcing trends. Furthermore, growing awareness of iron deficiency and the bioavailability of heme iron is pushing the use of heme supplements in sports nutrition, maternal health, and fortified foods.

In the healthcare sector, heme proteins are crucial for drug development, particularly in enzymatic assays, redox studies, and metabolic profiling. As pharmaceutical companies invest in novel therapies, heme proteins such as cytochrome P450 gain prominence for their role in drug metabolism and pharmacogenomics.

Market Applications: Where Are Heme Proteins Being Used?

Heme proteins have a wide spectrum of applications. In pharmaceutical and biotech R&D, they are indispensable in enzymatic studies, oxidative stress modeling, and therapeutic formulations. Cytochrome P450 enzymes are used extensively in drug-drug interaction studies, while hemoglobin derivatives are explored for oxygen therapeutics and biosensors.

In the food sector, heme proteins enhance the realism of meat analogs by simulating umami taste and pink coloring. The growing popularity of veganism and eco-conscious consumption has driven companies to develop fermentation-based heme solutions that are both safe and sustainable. Diagnostics is another key application area, where horseradish peroxidase (HRP) and cytochromes serve as key biomarkers in immunoassays and biosensors.

Environmental research also benefits from heme protein applications, particularly in bioremediation and sensing. Their redox activity makes them ideal candidates for detecting and degrading pollutants, thereby supporting sustainability initiatives.

Market Scope

| Parameter | Description |

|---|---|

| Base Year | 2024 |

| Forecast Period | 2025–2034 |

| Dominant Region | North America |

| Fastest-Growing Region | Asia Pacific |

| Segments Covered | Protein Type, Source, Application, End-Use, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, MEA |

Segmental Outlook: A Closer Look at the Value Chain

By protein type, hemoglobin dominated the market in 2024, accounting for 35% of revenue due to its widespread use in diagnostics and functional foods. Cytochrome P450 is the fastest-growing segment, particularly valued in pharmaceutical applications.

In terms of source, animal-based heme proteins still account for nearly 60% of production. However, the shift toward recombinant and synthetic/plant-derived sources is unmistakable. Recombinant proteins—produced using E. coli, yeast, or mammalian cells—are preferred for their purity, safety, and ethical acceptance.

On the application front, pharmaceuticals and drug discovery account for 40% of market share, driven by increasing reliance on heme-based enzymology. Food technology is quickly catching up as companies race to replicate the mouthfeel and taste of animal products using biosynthetic heme.

By end-user, pharmaceutical and biotech companies dominate with 50% market share, followed by food and beverage firms and research institutions.

Read Also: Medical Isotope Production Market (2025–2034): Powering the Future of Nuclear Medicine

Regional Insights: Where Is Growth Accelerating?

North America held the lion’s share in 2024 (39%) due to strong investments in biotech startups, R&D infrastructure, and consumer adoption of functional foods. The United States continues to lead thanks to FDA approvals for GRAS (Generally Recognized As Safe) status on soy-derived heme and broad patent protection for fermentation-based production.

Asia Pacific is the fastest-growing region, with countries like China, Japan, and India investing in food innovation, alternative proteins, and life sciences research. Government initiatives supporting biotechnology, combined with rising disposable income and health awareness, make the region a hotspot for heme protein applications.

Europe emphasizes sustainability, transparency, and clean-label ingredients. Countries like Germany and the UK are pioneers in synthetic biology and food tech, fostering an ecosystem conducive to recombinant heme protein development.

Competitive Landscape: Key Players Leading the Market

The heme protein market is moderately consolidated, with both legacy pharmaceutical companies and food tech innovators contributing to growth. Leading players include:

- Sigma-Aldrich (Merck KGaA)

- Thermo Fisher Scientific

- Abcam plc

- Impossible Foods Inc. (Known for soy leghemoglobin)

- Creative BioMart

- BioVision Inc.

- GenScript Biotech

- Novus Biologicals

- OriGene Technologies

- ProSpec – Protein Specialists

- Moolec Science (Plant-derived heme innovation)

- Ironic Biotech (Precision fermentation in Europe)

- HN Novatech (Seaweed-derived heme proteins)

These companies are investing in AI-driven protein modeling, CRISPR gene editing, and fermentation optimization to gain competitive advantage.

Recent Developments in the Heme Protein Landscape

- June 2025 – Moolec Science secured a USPTO patent for “Piggy Sooy,” an innovation enabling porcine heme protein production using soybean as a host platform.

- April 2024 – Ironic Biotech raised €1 million to scale its precision fermentation infrastructure for plant-based heme proteins.

- September 2023 – HN Novatech launched ACOMS, a seaweed-derived heme product targeting functional ingredients in food and skincare.

Final Thoughts: The Future of Heme Proteins

The next decade will see heme proteins expanding beyond traditional use cases into smart food systems, regenerative medicine, and personalized wellness solutions. As production techniques mature and AI continues to refine bioengineering strategies, heme proteins will become more accessible, sustainable, and functionally diverse.

For a connected market analysis on complementary technologies in diagnostics and radiopharmaceuticals, read our Medical Isotope Production Market report.