How Big Is the Opportunity in Complex Rehab?”

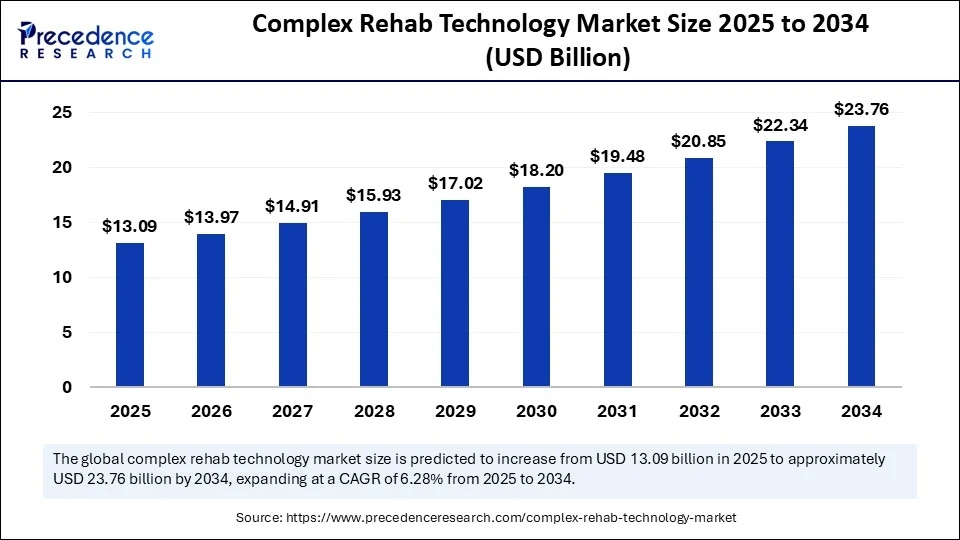

Between 2025 and 2034, the complex rehab technology market is projected to grow at a compound annual growth rate (CAGR) of 6.82%, reflecting both medical necessity and technological innovation. The market is poised to achieve substantial growth, particularly in regions with aging populations and robust healthcare infrastructure.

In 2024, North America held the largest revenue share, while Asia-Pacific emerged as the fastest-growing region. In the U.S. specifically, demand is propelled by institutional support and policy initiatives encouraging early and ongoing access to assistive mobility tools. As we approach 2034, the CRT market will increasingly be shaped by value-based care models, insurance reforms, and integration of emerging technologies.

Complex Rehab Technology Market Key Points

- In terms of revenue, the global fluoroalkyl-based coatings market was valued at USD 12.28 billion in 2024.

- It is projected to reach USD 23.76 billion by 2034.

- The market is expected to grow at a CAGR of 6.82% from 2025 to 2034.

- North America accounted for the largest market share of 52% in 2024.

- Asia Pacific is expected to grow at a solid CAGR of 9.28% 2025 and 2034.

- By product type, the seating and positioning systems segment led the market while holding a major share in 2024.

- By product type, the environmental control devices segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the neurological conditions segment led the market while holding he largest share in 2024.

- By application insight, the musculoskeletal conditions segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By age group, the geriatric segment led the market in 2024.

- By age group, the pediatric segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user, the hospitals & clinics segment led the market while holding a major share in 2024.

- By end-user, the sports and fitness centers segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel, the direct sales segment led the market in 2024.

- By distribution channel, the online retailers segment is expected to grow at a remarkable CAGR between 2025 and 2034.

Get a Sample: https://www.precedenceresearch.com/sample/6407

What’s Driving the Surge in Complex Rehab Technology?

The global need for complex rehab technology (CRT) is accelerating as healthcare systems strive to meet the growing demands of individuals with chronic disabilities, neurological disorders, and aging-related mobility issues. Increasing awareness about tailored healthcare, paired with advances in assistive technologies, is fueling the demand for personalized mobility devices. The rise in chronic diseases—such as cerebral palsy, muscular dystrophy, multiple sclerosis, and spinal cord injuries—has significantly heightened the need for complex rehab devices that enable independent living and enhance quality of life.

Today’s consumers aren’t just seeking equipment—they want smart, responsive solutions that fit their lifestyle. This shift is pushing manufacturers and providers to offer highly customized assistive devices. As healthcare becomes more proactive and person-centered, complex rehab technology is evolving into a critical pillar for long-term care management and functional mobility.

Why Is North America the Powerhouse of CRT?”

North America captured a commanding 52% market share in 2024, thanks to several factors converging in its favor. Medicare and Medicaid programs in the U.S. provide partial reimbursement for certain CRT devices, thereby easing financial burdens on families. Additionally, Assistive Technology Professional (ATP) certification ensures that clinicians and suppliers meet high standards in recommending and fitting complex equipment.

The region’s ecosystem of rehabilitation centers, specialty clinics, and innovation hubs, especially in cities like Boston, San Francisco, and Toronto, fosters constant advancement in mobility solutions. North America’s leadership also reflects its early adoption of AI and IoT in healthcare, enabling smarter and more integrated rehab tools.

Asia Pacific’s Acceleration: What’s Fueling It?

Asia-Pacific is outpacing all other regions in CRT market growth, driven by urbanization, rising healthcare investments, and government-supported rehabilitation programs. Countries like China, India, and Japan are witnessing a significant uptick in neurological disorders and post-surgical recovery needs due to aging demographics and evolving lifestyles.

Additionally, public-private partnerships are increasing access to assistive devices in rural and underserved areas. Programs promoting inclusive healthcare and mobility access—such as Japan’s advanced eldercare system or India’s Ayushman Bharat scheme—are laying the groundwork for long-term CRT expansion across the region.

How AI Is Making Rehab Smarter and More Personalized”

AI is revolutionizing complex rehab technology by transforming static devices into intelligent mobility solutions. Innovations include smart wheelchairs that auto-navigate environments, sensor-based posture tracking systems, and virtual assessments that eliminate the need for frequent clinic visits. These advancements are not just reactive, they proactively adapt to a user’s changing physical conditions.

By integrating machine learning algorithms, CRT systems can now analyze user data to fine-tune support levels, predict potential health risks, and improve overall outcomes. This shift toward predictive and personalized care is empowering both users and caregivers with greater control, confidence, and convenience.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 23.76 Billion |

| Market Size in 2025 | USD 13.09 Billion |

| Market Size in 2024 | USD 12.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.82% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Age Group, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Which Products Are Dominating and Why?

Among the various product types, seating and positioning systems dominate due to their critical role in supporting posture, circulation, and pressure distribution, especially in patients with severe physical impairments. These systems are foundational for preventing secondary health issues like pressure ulcers or spinal deformities.

Meanwhile, environmental control devices, which allow users to interact with their surroundings using voice commands or adaptive switches, are rapidly gaining traction. These solutions are especially beneficial for individuals with high-level spinal cord injuries or degenerative neurological conditions, enabling autonomy in daily activities like lighting, temperature control, and communication.

“Who Benefits Most: Neurological vs. Musculoskeletal Needs?”

The neurological disorders segment holds the largest market share in terms of application, owing to the complex and long-term rehabilitation required for conditions like ALS, Parkinson’s, and traumatic brain injuries. CRT plays a central role in improving motor function, communication, and mobility in these cases.

However, the musculoskeletal disorders segment is growing the fastest. Increasing instances of orthopedic surgeries, workplace injuries, and sports-related trauma have broadened the application of CRT beyond traditional neurological care. Devices designed for joint stabilization, pain management, and gradual mobility restoration are meeting this growing demand.

Read Also: Ventricular Tachycardia Ablation Market Size, Report by 2034

Geriatric vs. Pediatric: How Age Shapes CRT Demand”

The geriatric population is currently the largest consumer of complex rehab technologies. Age-related decline in mobility, coupled with a rise in chronic illnesses, has made CRT essential in eldercare. Solutions are often tailored for fall prevention, gait training, and safe home navigation.

On the other hand, pediatric applications are expanding rapidly. Early intervention in conditions like spina bifida or cerebral palsy can dramatically improve long-term outcomes. Customized mobility aids for children not only support physical development but also enhance social participation and educational engagement.

Where Is CRT Used Most?”

Hospitals and clinics remain the primary users of CRT, as they serve as the first point of intervention, diagnosis, and customization. Multidisciplinary teams in these settings ensure that devices are correctly fitted and monitored for effectiveness.

That said, sports and fitness centers are emerging as dynamic environments for CRT use, particularly in adaptive athletics and rehabilitation programs for injured athletes. These facilities are increasingly integrating CRT into high-performance training, offering personalized rehabilitation to restore and enhance functional capabilities.

From Clinics to Clicks: How CRT Is Sold Today

While direct sales channels continue to dominate due to the highly customized nature of CRT, online platforms are experiencing significant growth. E-commerce and telehealth are reshaping how patients access and manage their mobility solutions.

Virtual consultations, home assessments via video calls, and device trial shipments are making it easier for patients in remote or underserved areas to receive tailored care. As trust in digital healthcare grows, the convenience and reach of online CRT sales will likely increase further.

What Are the Roadblocks to Access?”

Despite technological advances, several challenges hinder access to complex rehab technology. High upfront costs, limited insurance coverage, and bureaucratic procurement processes slow adoption. Additionally, geographic disparities—particularly in rural and low-income regions—limit both access and continuity of care.

Workforce shortages, especially in ATP-certified professionals, further compound access issues, delaying evaluations and device fitting. Addressing these gaps will require coordinated efforts from policymakers, manufacturers, and care networks.

What’s Next? Opportunities in Innovation & Access”

Looking ahead, several innovations promise to transform CRT delivery and accessibility:

-

3D printing is making device customization faster and more cost-effective.

-

IoT integration enables remote monitoring, predictive maintenance, and enhanced user safety.

-

Tele-rehabilitation and home-based care are extending CRT beyond clinical walls, offering flexible support.

-

Sustainability initiatives, including eco-friendly materials and circular economy models, are emerging in response to environmental concerns.

-

Emerging markets in Latin America, Africa, and Southeast Asia represent untapped potential with increasing demand and policy support.