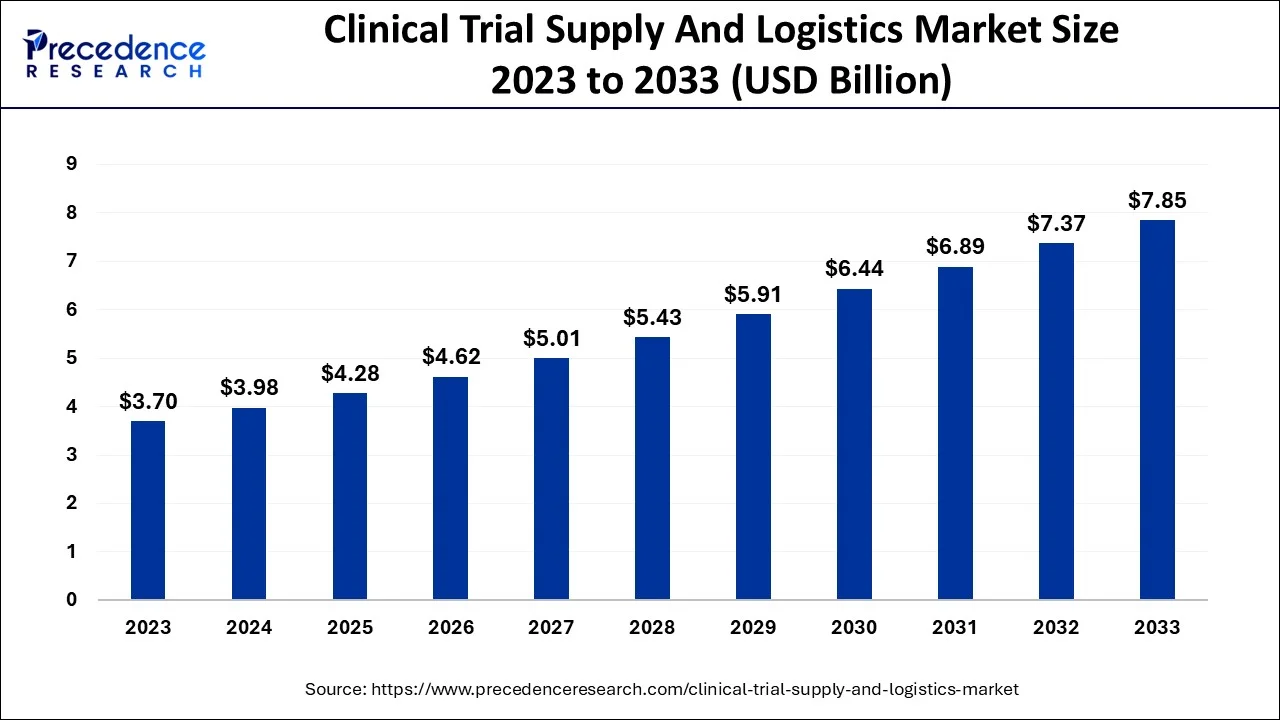

The global clinical trial supply and logistics market size was valued at USD 3.98 billion in 2024 and is expected to exceed USD 8.45 billion by 2034. In terms of CAGR, the market is accelerating at a strong compound annual growth rate (CAGR) of 7.84% from 2025 to 2034. The clinical trial supply and logistics market grows through online platforms, digital supply chains, IoT monitoring, and patient-centric delivery.

Clinical Trial Supply and Logistics Market Highlights:

- In terms of revenue, the clinical trial supply and logistics market accounted for USD 3,980 million in 2024.

- It is projected to achieve USD 8,450 million by 2034.

- The market is expected to grow at a solid CAGR of 7.84% from 2025 to 2034.

- North America held the major market share of 36% in 2024.

- By service, the logistics & distribution segment captured the biggest market share of 27.85% in 2024.

- By service, the manufacturing segment is projected to grow at a significant CAGR from 2025 through 2034.

- By phase, Phase 3 segment contributed the highest market share of 40.41% in 2024.

- By phase, Phase 2 segment is growing at a fastest CAGR between 2025 and 2034.

- By therapeutic area, the cardiovascular diseases segment captured the highest market share of 32.33% in 2024

- By therapeutic area, the rare diseases and orphan indications segment is poised to grow at a notable CAGR from 2025 to 2034.

- By end user, the pharmaceuticals segment held the largest market share of 42.22% in 2024

What is a Clinical Trial Supply and Logistics?

The clinical trial supply and logistics market is important in enabling the successful execution of clinical research in this respect by handling the end-to-end supply chain of investigational drugs, medical devices, and trial-related products. It involves proper planning, procurement, packaging, storage, distribution, and tracking to ascertain that clinical trials are conducted in a seamless fashion and satisfy high regulatory standards.

The market is experiencing strong growth due to increasing clinical trials in the world, which are supported by increasing chronic and rare diseases, personalized medicine, and innovations in biotechnology. The growing use of decentralized and virtual clinical trials is driving the urgency towards the implementation of digital supply chains and direct-to-patient delivery paradigms.

Top Trends in the Clinical Trial Supply and Logistics Market

- Rise of Decentralized and Virtual Trials

- Clinical trials are increasingly adopting decentralized models, requiring flexible and direct-to-patient (DTP) logistics, including home delivery of investigational products and remote monitoring support.

- Increased Demand for Cold Chain Logistics

- The growing number of biologics, gene therapies, and vaccines in trials is driving demand for ultra-cold storage and transport, with strict temperature monitoring and validated cold chain packaging.

- Adoption of Advanced Tracking & Visibility Technologies

- Real-time shipment tracking, IoT sensors, GPS-enabled containers, and blockchain are enhancing supply chain transparency, traceability, and risk mitigation during clinical trials.

- Growing Complexity of Global Trials

- With more trials spanning multiple countries and regulatory jurisdictions, there’s a rising need for specialized logistics providers familiar with cross-border compliance, customs clearance, and local site coordination.

- Personalized Medicine & Smaller Batch Sizes

- The rise in personalized therapies and precision medicine is leading to smaller, more complex batch production and just-in-time delivery models to avoid drug waste and improve trial efficiency.

- Sustainability in Clinical Supply Chains

- Sponsors are looking to reduce environmental impact by adopting eco-friendly packaging, optimizing transport routes, and using recyclable temperature-control materials in trial supply logistics.

- Increased Focus on Risk-Based Supply Planning

- Companies are using AI and predictive analytics to anticipate site demand, avoid shortages, and optimize inventory, especially in adaptive trial designs and global supply chains.

Clinical Trial Supply and Logistics Market Opportunity

Growing Partnerships Among Key Players:

The most promising opportunity in the clinical trial supply and logistics market is the growing partnerships among key players in the market. The strategic alliances are also helping businesses to increase their presence in the global marketplace, increase services, and reach more patients. These collaborative models automate the processes of the trials but also make trials more accessible to a variety of populations, including remotely isolated or underserved ones.

In addition, continuous initiatives to increase the scope of these partnerships to new territories are likely to fast-track the uptake of innovative logistics solutions across the globe.

Clinical Trial Supply and Logistics Market Major Challenge

Strict Regulatory Compliance:

Although the clinical trial supply and logistics market has a high growth potential, there is a big challenge of going through strict regulatory demands. The pharmaceutical and clinical trial industries have very strict regulatory structures that are set forth by regulatory authorities like the U.S Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

To make sure that good clinical practices (GCP) and good distribution practices (GDP) are observed, it is vital to document, exercise tight quality control, and conduct persistent audits. Such a regulatory burden hampers the execution of the trials also acts as a limiting factor to the expansion of the market, reducing scalability and operational effectiveness by the logistics providers.

Clinical Trial Supply and Logistics Market Report Scope

| Report Attributes | Statistics | |

| Market Size in 2024 | USD 3.98 Billion | |

| Market Size in 2025 | USD 4.29 Billion | |

| Market Size in 2031 | USD 6.94 Billion | |

| Market Size by 2034 | USD 8.45 Billion | |

| CAGR from 2025 to 2034 | 7.84% | |

| Largest Market | North America | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | Service, Phase, End-user, and Therapeutic Area | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa | |

Clinical Trial Supply and Logistics Market Key Regional Analysis

How Big is the U.S. Clinical Trial Supply and Logistics Market?

The U.S. clinical trial supply and logistics market size surpassed USD 1.44 billion in 2024 and is anticipated to reach approximately USD 2.96 billion by 2034, expanding at a CAGR of 7.53% between 2025 and 2034.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/3303

How North America Dominated the Clinical Trial Supply and Logistics Market?

North America dominated the clinical trial supply and logistics market in 2024. Drug and biotechnology research and development an international epicenters around the region, especially in the U.S. It hosts some of the largest pharmaceutical firms, contract research organizations, and academic research centers that are busy conducting clinical trials in the different fields of therapy.

Moreover, the well-developed infrastructure of the region, the use of cold chain technologies, and a high level of investment into R&D contribute to the market competence. An extremely strictly controlled setting, where regulatory bodies like the FDA are imposing strict requirements, is also a contributor to reliance on specialized logistics vendors that can make sure of compliance and product integrity.

Why is Asia Pacific the Fastest-Growing in the Clinical Trial Supply and Logistics Market?

Asia Pacific experiences the fastest growth in the market during the forecast period. The high growth of the region is supported by the high and varied number of patients in the area, which serves as an excellent source for conducting clinical trials. Also, the affordability of the trial process in various countries like China, India, and South Korea is a plus to make multinational pharmaceutical companies and CROs spend heavily in the region.

There is also a rise in government support, an increase in healthcare spending, as well as a better infrastructure in clinical research in the Asia Pacific. The increasing cases of chronic and rare diseases also drive the increase in the number of trials, which contributes to the need to provide effective supply and logistics solutions.

Read Also: Vehicle-to-Grid Technology Market Size to Surpass USD 49.75 Bn by 2034

Clinical Trial Supply and Logistics Market Segmentation Analysis

Service Analysis

The logistics & distribution segment dominated the clinical trial supply and logistics market in 2024. Due to the sensitive nature of clinical trial materials, the logistics providers should ensure product integrity using advanced cold chain, temperature-controlled packaging, and real-time tracking technologies.

The increased complexity of global clinical trials, which in most cases involves the use of multiple countries and hundreds of sites, has further increased the need to use efficient logistics and distribution services. Also, the growing scope of this segment is due to the need for last-mile delivery solutions because of the adoption of new models of trials, decentralized and direct-to-patient.

Phase Analysis

The phase III segment held the largest share in the clinical trial supply and logistics market in 2024. Phase III trials are commonly the largest phase of clinical research, consisting of thousands of subjects at multiple locations and often extending to more than one country. These trials require thorough logistics planning because of the scale and complexity of the trials; the supply of investigational drugs and other related materials needs to be consistent throughout all of the sites.

In contrast to the early-phase trials, phase III trials need a larger amount of drugs, a rigorous follow-up of dosing schedules, and powerful distribution monitoring systems.

End-user Analysis

The pharmaceuticals segment dominated the clinical trial supply and logistics market in 2024. Clinical trials play an important role in the pharmaceutical industry as they are the means by which the safety, efficacy, and regulatory compliance of new drugs and therapies are established prior to being marketed.

As more pharmaceutical firms invest in their R&D and the number of pipeline drugs is increasing, they are placing more of their trial operations in specialized supply and logistics suppliers. Delivery of products to trial sites in a timely and secure manner is critical to prevent delays and to enforce patient safety.

Therapeutic Area Analysis

The cardiovascular diseases segment held the largest share in the clinical trial supply and logistics market in 2024. Heart diseases are among the most frequent causes of death on a global scale, which leads to the high demand for innovative treatments and extensive research in the field of clinical studies. This prevalence has driven an increasing number of cardiovascular clinical studies, which have necessitated robust logistics to coordinate the delivery of study drugs, equipment, and monitoring apparatus to various locations and different regions. Also, continuous progress in drug development, biologics, and medical devices to address cardiovascular health is driving trial presence within this therapeutic field.

Clinical Trial Supply and Logistics Market Top Companies

- Almac Group

- DHL

- Parexel

- Thermo Fisher Scientific (Patheon)

- Marken

- Piramal Pharma Solutions

- UDG Healthcare

- Catalent, Inc.

- FedEx

- Movianto

- Packaging Coordinators Inc.

Recent Developments

- In March 2025, DHL Group acquired CRYOPDP of Cryoport Inc. in a bid to expand its life sciences and healthcare supply chain target. CRYOPDP aims to provide solutions to clinical trial logistics, biopharmaceuticals, and cell and gene therapy, and this will assist DHL to strengthen its global presence and offer advanced, reliable, and comfortable solutions in specialty courier services.

- In November 2024, FedEx added the Korea Life Science Center in Gimpo, South Korea. To ensure that the facility meets the pharmaceutical cold chain, it will include five temperature-controlled spaces with temperatures ranging between -150 °C and 25 °C.

- In June 2024, Thermo Fisher Scientific inaugurated an ultra-cold, cGMP-compliant facility in Bleiswijk, the Netherlands. This site adds to Thermo Fisher’s strengths in contract manufacturing and specialty logistics, serving pharmaceutical and biotech companies at all stages of clinical trials.