Making Automation the Standard: A Market on the Rise

Automatic labeling machines have become a core element of modern industrial and retail operations. These machines automate the process of applying labels to products and packages with precision, speed, and consistency, whether it’s a barcode on a logistics box, an ingredient label on a juice bottle, or a tracking code on a pharmaceutical vial. In an era of increasing product volumes, regulatory scrutiny, and consumer expectations, automation in labeling is no longer optional.

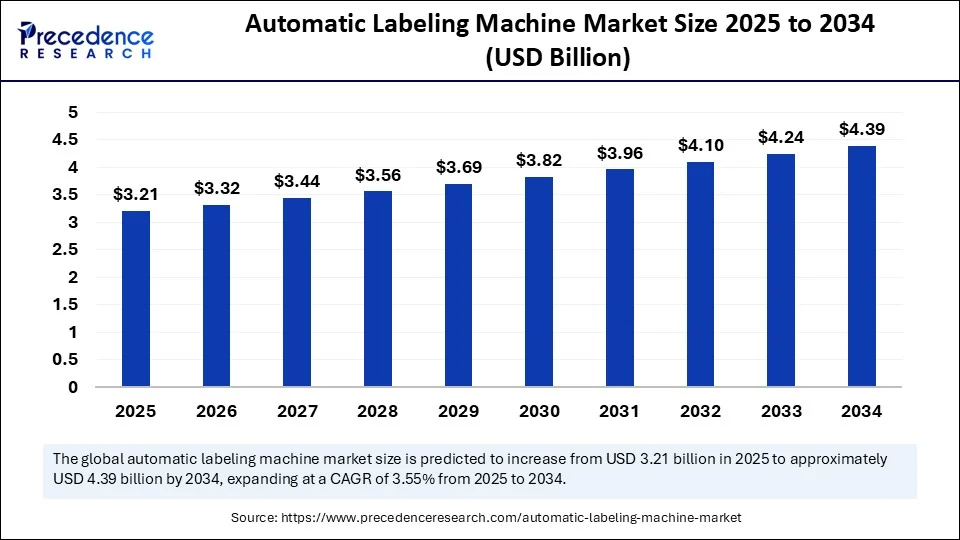

Recent data shows the automatic labeling machine market was valued at USD 3.10 billion in 2024, and it’s set to reach USD 4.39 billion by 2034, expanding at a CAGR of 3.55%. This growth reflects rising demand in key verticals like food & beverage, pharmaceuticals, cosmetics, and e-commerce, where efficient and accurate labeling is crucial. For deeper insights on this upward trend, explore the automatic labeling machine market report.

Smart Machines and AI: Redefining Labeling Accuracy

Today’s labeling machines are increasingly intelligent, thanks to the infusion of Artificial Intelligence (AI), machine vision, and smart sensors. AI enables machines to detect defects in real-time, automatically adjust label placement, and trigger maintenance alerts before breakdowns occur. This predictive capability significantly reduces downtime, enhances label accuracy, and minimizes human intervention.

These AI-driven systems are particularly beneficial in high-throughput industries like electronics and semiconductor packaging, where labeling mistakes can lead to costly recalls. They also play a key role in automated quality control, an essential trend within the broader machine vision market, which supports these innovations.

Get a Sample: https://www.precedenceresearch.com/sample/6384

Regional Momentum: Asia Pacific Surges, MEA Catches Up

Geographically, Asia Pacific holds the dominant position, accounting for over 41% of global market share in 2024. Countries like China, India, Vietnam, and Indonesia are transforming into global manufacturing hubs due to infrastructure investments, favorable trade policies, and a growing appetite for export competitiveness. These nations are also rapidly deploying smart factory solutions, further accelerating the adoption of intelligent labeling systems.

Meanwhile, the Middle East & Africa (MEA) is emerging as the fastest-growing regional segment. With governments in countries like the UAE, Saudi Arabia, and South Africa pushing for industrial automation and compliance modernization, demand for labeling machines is climbing steadily. The broader trend of regional infrastructure investment aligns with the momentum seen in the industrial automation market, which supports these technological shifts.

Demand Drivers: Traceability, Safety, and Digital Packaging

Key drivers fueling this market include the demand for traceability, smart packaging, and product authentication. In pharmaceuticals, serialization has become legally mandated across many regions, requiring unique identification for every product unit. This not only improves safety but also helps track inventory and prevent counterfeiting.

Additionally, contract manufacturing, especially in consumer goods and nutraceuticals, has led to a higher demand for flexible, multi-product labeling lines. The push for clean labeling and sustainable packaging is also prompting manufacturers to rethink how labels are applied, driving investments in linerless labels and environmentally friendly adhesives. These dynamics mirror larger shifts in the sustainable packaging market, where traceable, smart labeling is a natural extension.

Barriers for Smaller Enterprises: The Cost Challenge

Despite the widespread benefits, adoption is not universal. Small and mid-sized enterprises (SMEs) often find it difficult to invest in high-end systems equipped with AI, RFID, or servo-controlled mechanisms. These advanced machines require not only capital but also skilled operators and maintenance infrastructure.

As a result, businesses with limited throughput or seasonal product lines may delay automation, opting for manual or semi-automatic systems. While ROI improves significantly over time, the upfront cost continues to be a limiting factor, especially in cost-sensitive economies. This reflects similar adoption challenges seen in the broader robotics market, where high entry costs can delay transformation for smaller firms.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.39 Billion |

| Market Size in 2025 | USD 3.21 Billion |

| Market Size in 2024 | USD 3.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.55% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, Orientation, Application, End-User, Speed Capacity, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The Future Is Smart: Technology-Driven Opportunities

The future of labeling automation is anchored in technological convergence. Machines are evolving with built-in IoT modules, vision-guided systems, and cloud-enabled analytics that allow operators to monitor performance remotely and receive predictive alerts. Integration with enterprise software ensures that label data is linked to order management, warehouse operations, and regulatory databases.

Furthermore, advancements in self-correcting systems and edge computing are enabling on-the-fly decision-making by labeling machines—paving the way for autonomous packaging lines. These upgrades are well aligned with the transformation happening in the industrial IoT market, where smart connectivity is a key growth driver.

Market Segmentation: Understanding the Leaders and Rising Stars

By Type, pressure-sensitive labelers maintain leadership with 38% market share, driven by their flexibility and compatibility with various substrates. However, RFID labelers are quickly gaining ground, especially in industries that require real-time asset tracking and inventory control.

By Technology, fully automatic machines dominate due to their use in mass production environments, while print & apply systems are surging thanks to their ability to deliver variable data printing on-the-go.

In terms of orientation, side labelers are most common, but top & bottom labelers are growing fast due to their ability to handle dual-surface printing—ideal for flexible packaging formats. These innovations are highly relevant to the expanding flexible packaging market, where lightweight, resealable formats are now standard.

By Application, bottles and jars hold the largest share due to widespread usage in beverages, sauces, and personal care items. However, pouches and flexible packs are seeing rapid adoption across health and wellness categories.

Among end-users, food & beverage leads with 37% share, driven by the need for high-speed, hygienic, and export-compliant labeling. Meanwhile, the logistics and e-commerce sector is adopting high-speed labelers for real-time barcode printing, routing, and inventory tracking—especially during warehouse automation.

Read Also: Scroll and Absorption Chillers Market Size to Worth USD 21.08 Billion by 2034

Key Players in the Market: Innovation as a Differentiator

Market leaders are focusing on innovation, scalability, and intelligent systems. Prominent players include Krones AG, Domino Printing Sciences, Herma GmbH, FUJI Seal International, Videojet, Label-Aire, and Sato Holdings.

Recent product releases showcase the innovation trajectory:

-

Domino’s Mx-Series introduced in 2024 offers GS1-compliant high-speed labeling with cloud reporting.

-

Epson’s SurePress L-6534VW delivers precise digital label printing for niche and short-run applications.

-

SATO’s LR4NX Series provides intelligent labeling for high-volume industrial operations in Europe.

These players continue to shape the competitive landscape through smart solutions and global reach, closely following trends tracked within the broader packaging automation market.

Strategic Trends: Toward Intelligence, Sustainability, and Global Compliance

As industries scale globally, universal compliance with labeling regulations (FDA, EU, APAC) is becoming mandatory. This demands labeling systems that are not only fast and smart but also modular, scalable, and connected to enterprise systems.

Cloud-based diagnostics, remote servicing, and data-driven maintenance will be central to reducing operational friction. Meanwhile, sustainable trends—like linerless labels, compostable adhesives, and recyclable substrates—will redefine labeling materials and formats for decades to come.

These developments indicate a shift from labeling as a mechanical process to labeling as an intelligent supply chain function, closely tied to real-time analytics and sustainability goals.