Market Overview

Ventricular tachycardia (VT) is a life-threatening cardiac arrhythmia originating in the ventricles—the heart’s lower chambers—that leads to rapid, abnormal heartbeats. If untreated, VT can escalate to ventricular fibrillation and sudden cardiac death. VT ablation, a minimally invasive procedure that uses energy (radiofrequency or other forms) to destroy abnormal heart tissue responsible for erratic signals, has become a cornerstone in modern cardiac rhythm management.

The rising global burden of cardiovascular diseases (CVDs)—driven by aging populations, sedentary lifestyles, hypertension, obesity, and diabetes—has significantly amplified the demand for effective VT treatments. The World Health Organization (WHO) estimates that CVDs are responsible for over 17.9 million deaths annually, accounting for 32% of global mortality. Within this vast clinical challenge, VT stands out due to its complexity, recurrence risk, and treatment resistance.

Unlike atrial arrhythmias, VT often requires highly advanced imaging, mapping, and ablation strategies. The intricate nature of ventricular structures—especially in patients with structural heart disease—demands a convergence of sophisticated technologies. The VT ablation landscape is increasingly shaped by innovations in AI, catheter design, energy sources, and navigation systems, making it one of the most dynamic frontiers in interventional cardiology.

Get a Sample: https://www.precedenceresearch.com/sample/6390

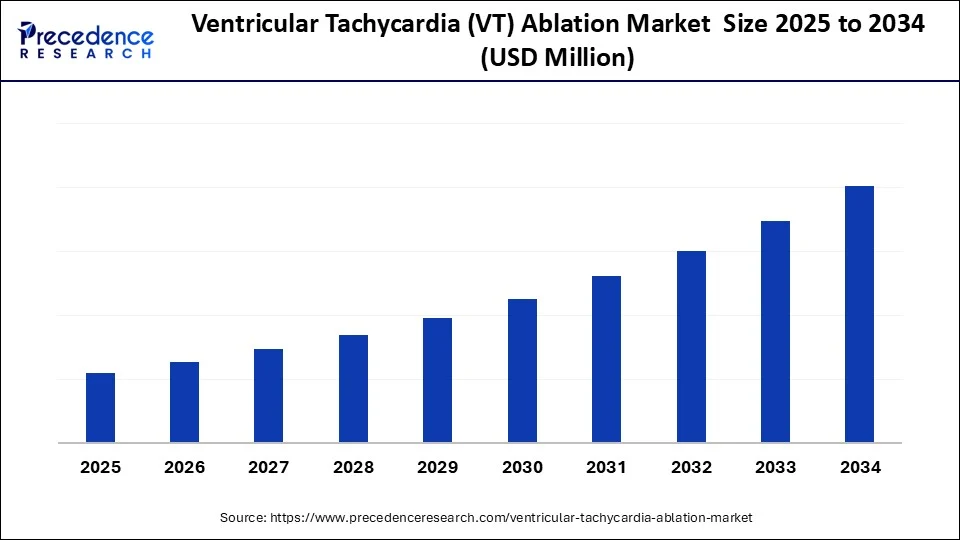

Market Size and Growth Outlook (2025–2034)

The global ventricular tachycardia ablation market is poised for robust expansion, with a projected compound annual growth rate (CAGR) of 9.2% from 2025 to 2034. As the demand for advanced arrhythmia management grows, the market is expected to reach a multi-billion-dollar valuation by the end of the forecast period.

Key drivers include:

-

Aging global population: By 2030, one in six people will be over 60, increasing the prevalence of structural heart disease and VT.

-

Rise in lifestyle diseases: Obesity, metabolic syndrome, and type 2 diabetes are strongly associated with ischemic heart disease and VT episodes.

-

Growing awareness and screening: Increasing adoption of wearable cardiac monitors and remote ECG diagnostics has enhanced VT detection and early intervention.

-

Advancements in mapping and imaging tools: Improved identification of VT circuits enhances ablation outcomes and procedural success.

Key Market Takeaways (2024 Baseline Year)

In 2024, the VT ablation market established a strong global presence, with the following takeaways highlighting its foundational dynamics:

-

North America accounted for 41% of global market revenue, driven by technological leadership, reimbursement pathways, and specialized cardiac centers.

-

Asia Pacific emerged as the fastest-growing region, propelled by a rapid rise in cardiovascular disease prevalence, healthcare infrastructure improvements, and expanding access to electrophysiology labs.

-

Radiofrequency (RF) ablation led the technology segment with a 72.5% share, maintaining its dominance due to established clinical efficacy and familiarity.

-

Catheter-based ablation procedures comprised 86.5% of interventions, preferred for their minimally invasive nature and lower complication risks.

-

Ablation catheters contributed to 41% of the product segment revenue, highlighting their critical role in precision lesion delivery.

-

Structural heart disease-related VT represented 60% of all ablation indications, underscoring the need for complex mapping and intervention.

-

Hospitals with dedicated electrophysiology (EP) labs constituted 66.5% of procedures, benefiting from multidisciplinary expertise and access to advanced imaging.

Emerging and fastest-growing segments include:

-

Pulsed Field Ablation (PFA): Offering selective tissue ablation with minimal collateral damage, PFA is rapidly gaining traction.

-

Surgical VT ablation: Especially valuable in complex structural cases refractory to catheter-based approaches.

-

Electroanatomical mapping and navigation systems: Experiencing a surge due to their real-time 3D capabilities.

-

Idiopathic VT ablation: Rising as more cases are identified in structurally normal hearts.

-

Academic and research institutions: Gaining momentum due to rising clinical trials and innovation partnerships.

How is AI Transforming the VT Ablation Landscape?

Artificial Intelligence (AI) is revolutionizing electrophysiology, introducing new dimensions in accuracy, personalization, and predictive modeling. In the context of VT ablation, AI contributes across the procedural continuum:

-

Imaging and Mapping: AI algorithms interpret 3D electroanatomical data to pinpoint VT circuits with higher precision, especially in scar-mediated arrhythmias.

-

Procedure Planning: By integrating patient-specific data, AI aids in creating optimized, targeted ablation plans tailored to anatomical variations.

-

Catheter Navigation: AI enhances robotic catheter movement and real-time responsiveness, reducing operator fatigue and improving safety.

-

Feedback Loops: Real-time machine learning models adjust energy delivery based on tissue response, enhancing lesion durability.

-

Personalized Treatment: AI leverages historical procedural data and patient records to identify success predictors, guiding personalized therapeutic decisions.

-

Outcome Prediction: Post-procedural AI models forecast recurrence risks and long-term survival, supporting proactive follow-up strategies.

AI’s integration into EP labs is not just futuristic—it is actively reshaping how VT ablation is conducted, transforming it from operator-dependent art to data-driven precision science.

Ventricular Tachycardia Ablation Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Procedure Type, Product Type, Indication, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Growth Drivers

Several compelling forces are driving the sustained momentum of the VT ablation market:

1. High Prevalence of Underlying Cardiac Conditions

VT is often secondary to coronary artery disease (CAD), myocardial infarction (MI), and heart failure. With CAD affecting nearly 200 million people globally, the VT population is set to grow in parallel.

2. Technological Advancements

Innovations such as force-sensing catheters, robotic ablation systems, and contactless ablation tools like PFA are making VT treatment safer and more effective. These advances allow for deeper lesions and better substrate modification, improving long-term arrhythmia control.

3. Shift Toward Minimally Invasive Interventions

Minimally invasive VT ablation procedures are favored over antiarrhythmic drug therapy or open-heart surgeries due to faster recovery, fewer complications, and higher efficacy in arrhythmia recurrence prevention.

4. Geriatric Population Expansion

Elderly individuals are more likely to suffer from VT, especially those with pacemakers, heart failure, or implantable cardioverter defibrillators (ICDs). This demographic trend adds consistent demand for VT ablation.

5. Improved Mapping and Success Rates

The success of VT ablation hinges on accurately identifying abnormal circuits. With cutting-edge high-density mapping catheters and integration of MRI/CT imaging, procedural outcomes are significantly improving.

Challenges and Restraints

Despite its promise, the VT ablation market faces a few key challenges:

-

High Cost of Procedures and Equipment: Advanced catheter systems, robotic navigation platforms, and AI-assisted tools elevate the cost burden, especially in low- and middle-income countries.

-

Procedural Complexity: VT ablation is inherently more complicated than atrial fibrillation ablation, requiring longer procedures and higher operator skill.

-

Risk of Complications: There are tangible risks including stroke, vascular damage, infection, or cardiac tamponade—particularly in patients with structural heart abnormalities.

-

Workforce Dependency: A limited pool of electrophysiologists globally—combined with the steep learning curve—acts as a bottleneck in scaling services.

Read Also: Venous Leg Ulcer Market (2025–2034): A Deep Dive into a Growing Global Healthcare Challenge

Opportunities Shaping the Future

1. Non-Invasive Techniques

The emergence of Stereotactic Ablative Radiotherapy (STAR)—a completely non-invasive method targeting arrhythmic substrates using radiation—holds transformative potential. STAR is especially valuable in refractory VT cases or those contraindicated for catheter ablation.

2. Growing Research Investment

Both public and private sectors are investing heavily in R&D for new VT ablation strategies, energy sources, and AI-based procedural support, opening up pathways for faster innovation adoption.

3. Telemedicine and Remote Monitoring Integration

Post-ablation patient management is being enhanced through wearable ECG devices, mobile health apps, and AI-driven risk alerts—extending VT care beyond the lab.

Segment Analysis

By Technology

Radiofrequency (RF) ablation continues to dominate due to its proven efficacy and clinician familiarity. However, Pulsed Field Ablation (PFA) is gaining momentum for its ability to selectively target myocardial tissue while sparing surrounding structures like nerves and blood vessels.

By Procedure Type

Catheter-based ablation is the standard of care, preferred for its minimally invasive nature. However, surgical ablation still plays a role in complex VT cases—especially during open-heart surgery or when catheter approaches fail.

By Product Type

Ablation catheters remain the backbone of procedural success, with increasing demand for flexible, steerable, and contact-force sensing models. In parallel, mapping and navigation systems are witnessing exponential growth due to the need for anatomical and electrophysiological accuracy.

By Indication

Structural VT (post-MI or cardiomyopathy patients) dominates, given the high incidence of scar-mediated arrhythmias. Idiopathic VT, though smaller in share, is growing rapidly as diagnostic technologies uncover more cases in younger, structurally normal patients.

By End Use

Hospitals with EP labs lead the market due to availability of integrated technology and specialist teams. Academic and research institutes are accelerating due to growing clinical trials and exploratory ablation strategies.

Regional Market Insights

North America

As the global leader, North America benefits from a mature healthcare ecosystem, broad insurance coverage, and a high concentration of skilled electrophysiologists. The U.S. in particular boasts widespread adoption of robotic mapping tools and AI-powered platforms.

Europe

Driven by an aging population and high healthcare spending, Europe is investing heavily in VT research and transitioning toward AI-based surgical planning. Countries like Germany and the Netherlands are at the forefront of minimally invasive rhythm therapy innovation.

Asia Pacific

Home to the highest number of heart disease patients, Asia Pacific is witnessing the fastest market growth. Rising investment in cardiac care, urbanization, and public health awareness in China, India, and Southeast Asia is fueling infrastructure expansion.

Latin America & Middle East/Africa (MEA)

These are emerging markets, showing steady progress in improving access to advanced cardiology services. Brazil, Saudi Arabia, and South Africa are spearheading regional development through public-private healthcare partnerships.

Key Players and Competitive Landscape

The VT ablation market is moderately consolidated, with a mix of global medical device giants and nimble innovators:

-

Biosense Webster (Johnson & Johnson): A global leader in mapping and navigation systems, including the CARTO 3 platform.

-

Abbott: Known for its EnSite Precision system and sensor-enabled FlexAbility ablation catheters.

-

Medtronic: Offers comprehensive solutions for VT detection, ICDs, and ablation synergy.

-

Boston Scientific: Pioneers in AI-assisted procedural tools and integration with imaging modalities.

-

Stereotaxis: Specializes in robotic magnetic navigation for precision catheter steering.

-

Acutus Medical: Focuses on real-time, high-resolution cardiac mapping and ablation technologies.

-

Biotronik and MicroPort: Prominent in Europe and Asia, expanding rapidly through novel device introductions.

-

Adagio Medical and Baylis Medical: Active in advanced cryoablation and minimally invasive device development.

Companies are continuously pursuing strategic acquisitions, cross-platform collaborations, and AI R&D initiatives to fortify their market share.