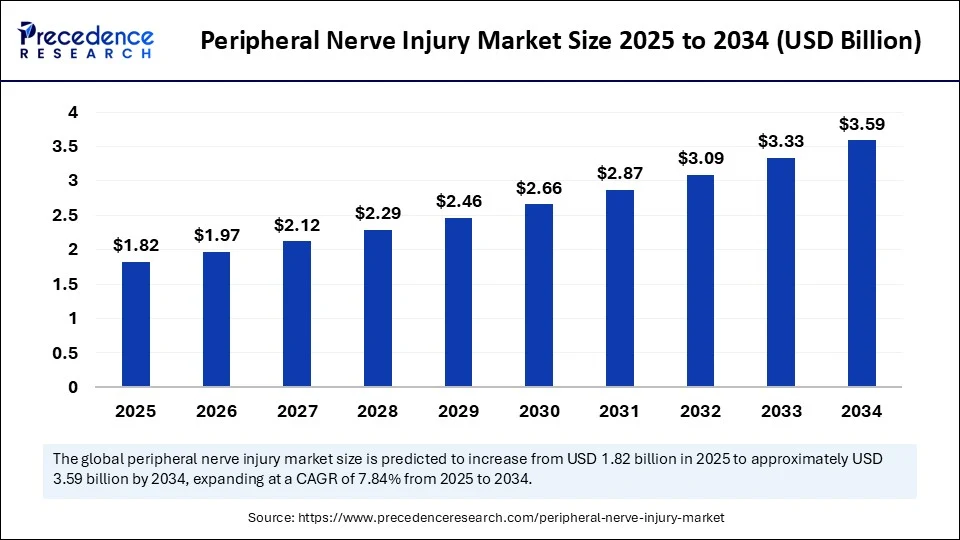

The global peripheral nerve injury (PNI) market is poised at the intersection of critical clinical need and technological innovation. Peripheral nerve injuries, disruptions to nerves outside the brain and spinal cord, can have life-altering consequences, ranging from partial motor dysfunction to complete paralysis. The increasing incidence of trauma-related injuries, a growing geriatric population, and rapid advancements in nerve repair technologies have collectively propelled this market into sharp focus for medical device manufacturers, healthcare providers, and investors alike. In 2024, the peripheral nerve injury market was valued at USD 1.69 billion and is projected to more than double, reaching USD 3.59 billion by 2034, registering a robust CAGR of 7.84%. This growth trajectory underscores the urgency and opportunity within this specialized segment of neuroregenerative medicine.

Peripheral Nerve Injury Market Key Points

- In terms of revenue, the global peripheral nerve injury market was valued at USD 1.69 billion in 2024.

- It is projected to reach USD 3.59 billion by 2034.

- The market is expected to grow at a CAGR of 7.84% from 2025 to 2034.

- North America dominated the peripheral nerve injury market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By product type, the nerve conduits segment held the biggest market share of 64% in 2024.

- By product type, the nerve wraps segment is expected to grow at the fastest CAGR during the forecast period.

- By surgical technique, the direct nerve repair segment led the market in 2024.

- By surgical technique, the stem cell therapy segment is expected to grow at the fastest rate in the upcoming period.

- By treatment material, the autografts/allografts segment generated the major market share in 2024.

- By treatment material, the biomaterials segment is likely to grow at the fastest CAGR over the studied period.

- By application, the upper extremity segment captured the biggest market share in 2024.

- By application, the lower extremities segment is observed to grow at the fastest rate during the forecast period.

Get a Sample: https://www.precedenceresearch.com/sample/6388

Market Overview

The PNI market comprises a diverse array of therapeutic and interventional products and techniques, including nerve conduits, nerve grafts, wraps, biologics, and neurostimulation therapies. These components are aimed at restoring nerve function, managing pain, and improving quality of life for patients suffering from trauma, surgical complications, or degenerative conditions. Traumatic injuries—resulting from motor vehicle accidents, falls, or sports, remain a leading cause of nerve damage. Additionally, metabolic disorders such as diabetes contribute to peripheral neuropathies, further expanding the patient pool. The growing demand for nerve repair solutions is amplified by an aging global population, where the risks of nerve degeneration and delayed healing are significantly elevated.

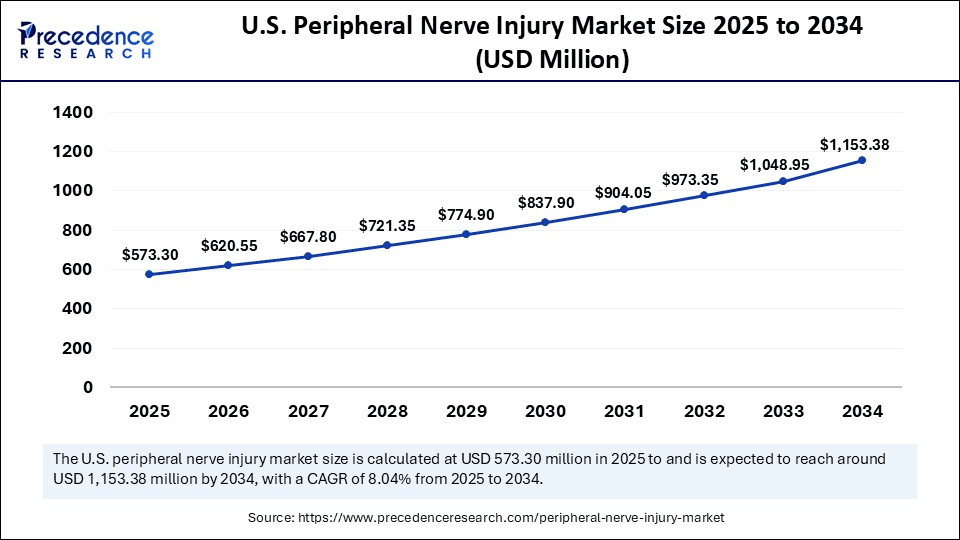

U.S. Market Focus

The United States stands as a dominant force in the global PNI market, with an estimated market size of USD 532.35 million in 2024 and a forecast to reach USD 1.15 billion by 2034, advancing at a CAGR of 8.04%. This growth is underpinned by several structural and systemic advantages: an advanced healthcare infrastructure, high patient awareness, and a strong ecosystem of clinical research and regulatory pathways. Early adoption of minimally invasive nerve repair technologies, coupled with favorable reimbursement frameworks and an active base of neurosurgeons and microsurgical specialists, positions the U.S. as a critical growth engine for both legacy companies and emerging innovators in the field.

Regional Insights

North America, led by the U.S., accounted for approximately 35% of the global PNI market in 2024, driven by the high incidence of trauma, the presence of a geriatric population with greater nerve vulnerability, and robust insurance coverage for nerve repair procedures. In contrast, Asia Pacific is emerging as the fastest-growing regional market, buoyed by rising healthcare expenditures, improved hospital infrastructure, and a disproportionately high rate of road accidents and workplace injuries. Government investments in regenerative medicine and the establishment of local manufacturing units for nerve repair devices are also contributing to APAC’s acceleration. Europe remains a mature market with a focus on regulatory harmonization and cross-border research collaborations, while Latin America and the Middle East & Africa (MEA) are witnessing gradual improvements in nerve injury care, largely through public-private partnerships and NGO-led surgical outreach programs.

Market Coverage

| Report Attribute | Details |

| Market Size by 2034 | USD 3.59 Billion |

| Market Size in 2025 | USD 1.82 Billion |

| Market Size in 2024 | USD 1.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Surgical Technique, Application, Treatment Material, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The rising incidence of road traffic accidents, industrial injuries, and sports-related trauma continues to be a significant catalyst for the peripheral nerve injury market. The global surge in demand for minimally invasive surgeries—driven by patient preferences for reduced pain, quicker recovery times, and outpatient care models—has also expanded the use of nerve conduits and biologics. Furthermore, aging populations are particularly susceptible to nerve damage due to lower regenerative capacity, making them prime beneficiaries of emerging nerve repair technologies.

Technological advancements have transformed the treatment landscape. Innovations such as stem cell therapies, bioengineered 3D scaffolds, AI-based diagnostics, and advanced neurostimulation devices are not only enhancing repair outcomes but also enabling personalized treatment strategies. These tools are backed by increasing R&D investments and regulatory support, including fast-track FDA approvals and expanding clinical trials for novel biologics and scaffold-based therapies.

Read Also: Scroll and Absorption Chillers Market Size to Surpass USD 21.08 Billion by 2034

Market Restraints

Despite its promising outlook, the market faces some critical challenges. A significant limitation is the scarcity of highly trained microsurgeons and neurosurgical specialists, particularly in rural and underserved regions of developing countries. Moreover, severe or chronic nerve injuries often present complications such as low recovery rates and high reoperation risks, which limit the efficacy of currently available treatments. These hurdles call for enhanced clinical training programs and more scalable, technology-driven solutions.

Emerging Opportunities

One of the most transformative frontiers in this space is the integration of stem cell therapies and regenerative medicine. The ability of stem cells to differentiate into functional nerve tissues, when combined with 3D-printed biodegradable scaffolds, opens up new possibilities for complex nerve reconstructions. Biotech firms and academic institutions are actively collaborating to refine these approaches and scale them for clinical deployment.

Another compelling opportunity lies in the personalization of nerve injury treatment. Artificial intelligence is now being deployed to analyze genetic profiles and diagnostic imaging, enabling clinicians to craft individualized nerve repair plans using customized grafts and biologic materials. These precision medicine approaches are expected to significantly improve surgical outcomes and reduce complications.

Product Type Analysis

Nerve conduits held the largest share of the PNI market in 2024, accounting for 64% of total revenues. Their widespread use in managing nerve gaps, along with the growing availability of biodegradable options, makes them a staple in trauma and surgical repair settings. Meanwhile, nerve wraps are projected to grow at the fastest pace during the forecast period. Their efficacy in preventing scarring and compression neuropathies, especially in revision surgeries, is gaining clinical endorsement.

Surgical Technique Analysis

Direct nerve repair remains the most commonly employed technique, especially in clean-cut injuries with minimal tissue loss. Its cost-effectiveness and simplicity make it the preferred approach in trauma centers globally. However, stem cell therapy is experiencing the fastest growth, driven by positive trial outcomes, increased investment in regenerative platforms, and its compatibility with bioengineered materials that support nerve regrowth.

Treatment Material Analysis

Autografts and allografts continue to dominate the treatment material landscape due to their biological compatibility and effectiveness in treating long-gap injuries. However, biomaterials are emerging as the fastest-growing category. Smart scaffolds made from synthetic polymers are increasingly being integrated with drug-delivery systems, further enhancing their therapeutic potential and adoption among surgeons seeking scalable alternatives to traditional grafts.

Application Outlook

In 2024, upper extremity injuries—particularly those affecting the hands and arms—constituted the largest application segment. These injuries are easier to access surgically and more frequently encountered in occupational and accidental trauma scenarios. Conversely, lower extremity injuries are expected to grow at a higher rate due to the rising prevalence of diabetic neuropathy, sports-related leg injuries, and vehicular trauma affecting the lower limbs.

Role of AI in Peripheral Nerve Injury Diagnosis

Artificial intelligence is emerging as a pivotal tool in enhancing diagnostic accuracy and accelerating treatment timelines in the PNI market. By processing large datasets from MRI, CT, and EMG scans, AI algorithms can detect subtle signs of nerve damage, classify injury severity, and predict recovery trajectories. These insights enable clinicians to formulate targeted intervention plans, ultimately improving patient outcomes and reducing procedural delays.

Competitive Landscape

- AxoGen, Inc.

- Stryker Corporation

- Baxter International, Inc.

- Integra Lifesciences Corporation

- Polyganics BV

- Renerva, LLC

- Toyobo Co., Ltd.

- Newrotex

- Orthocell Ltd

- Medovent

- Auxilium Biotechnologies

- BioCircuit Technologies

- Isto Biologics

- Alafair Biosciences

- Fibrant

- Alafair Biosciences

- Orthocell Ltd

- Cleveland Clinic (research partner)

- University of Oxford (research collaborator)

- Medtronic (neurostimulation)