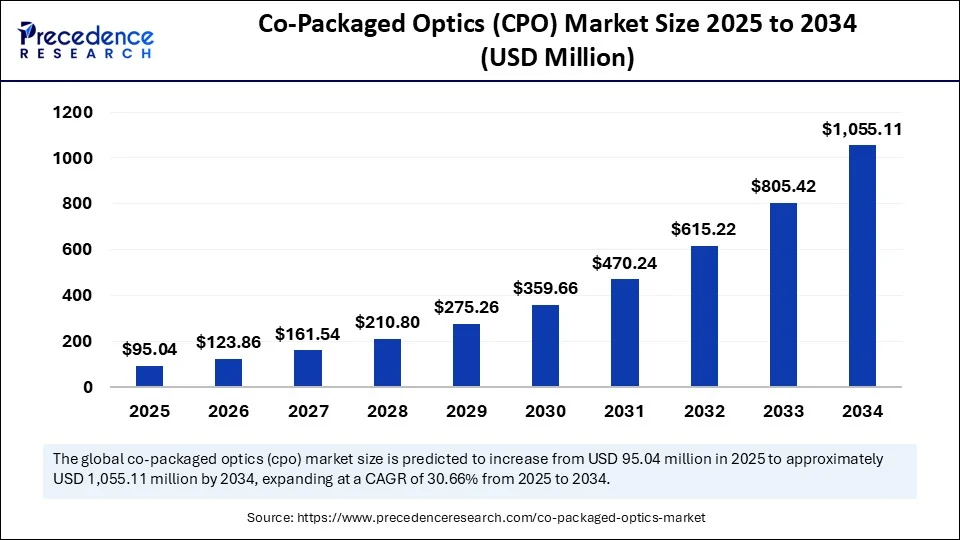

The global co-packaged optics (CPO) market is on the cusp of explosive expansion, fueled by the insatiable demand for high-speed, low-latency data transfer in hyperscale data centers and AI-powered applications. According to Precedence Research, the market soared to USD 72.97 million in 2024 and is forecast to leap to USD 1,055.11 million by 2034, representing a robust CAGR of 30.66% over the 2025–2034 period. This unprecedented growth is driven by the transformation of data center infrastructure, rising adoption of artificial intelligence, and a global shift toward energy-efficient and scalable networking solutions.

Quick Insights

-

2024 Market Value: USD 72.97 million

-

2025 Forecast Value: USD 95.04 million

-

2034 Forecast Value: USD 1,055.11 million

-

CAGR (2025–2034): 30.66%

-

Leading Region: North America

-

Fastest-Growing Region: Asia Pacific

-

Top Company (Sample Value Chain): Intel, Broadcom, NVIDIA, Ayar Labs

-

Major Growth Driver: Escalating demand for high-speed data centers and AI-driven workloads

Get a Sample: https://www.precedenceresearch.com/sample/6705\

Market Revenue Highlights

| Report Coverage | Details |

|---|---|

| Market Size by 2034 | USD 1,055.11 Million |

| Market Size in 2025 | USD 95.04 Million |

| Growth Rate 2025–2034 | CAGR 30.66% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Segments (2024 Dominance) | Optical Engines/Transceivers, Intra-Rack, Data Centers |

Where Are the Biggest Growth Opportunities?

The rapid proliferation of AI and machine learning applications is revolutionizing the CPO market. As data volumes surge, next-gen data centers require ultra-high-bandwidth and ultra-low-latency networks—exactly what CPO delivers. AI is also being leveraged to design and optimize optical components and streamline manufacturing precision. Massive investments from hyperscale operators like Google, Microsoft, and NVIDIA signal robust, sustained demand.

Furthermore, expanding application areas in quantum computing, scientific research, and smart city infrastructure are poised to unlock new value pools for CPO vendors. The drive toward sustainability and operational efficiency is making energy-efficient CPO solutions more attractive to data center and cloud service operators worldwide.

Expert Commentary

“The co-packaged optics market is entering a period of transformative growth, driven by monumental shifts in AI, cloud, and data-centric computing infrastructure,” remarks Dr. R. Mahadevan, Principal Consultant at Precedence Research. “Leveraging advances in silicon photonics and next-generation integration, CPO platforms are eliminating bottlenecks, slashing power consumption, and powering the world’s most demanding data environments. As technology and deployment hurdles are addressed, this sector is primed to become a cornerstone of the future digital economy.”

Regional & Segmentation Analysis

Regional Outlook

-

North America holds the current market lead, fueled by robust data center investment, a dynamic cloud services ecosystem, and a strong base of optical component manufacturers and technology powerhouses (notably the U.S. and Canada).

-

Asia Pacific is set to experience the fastest growth, propelled by rapid digital transformation in China, Japan, and South Korea; formidable manufacturing capabilities; and massive R&D outlays.

-

Europe continues to contribute through ongoing network modernization and supportive policy frameworks, while Latin America and Middle East & Africa are emerging with steady, infrastructure-focused growth.

Segmentation — Component & Integration

-

Optical Engines/Transceivers: This component led the market in 2024, critical for high-speed intra- and inter-data center links. Progress in silicon photonics and miniaturized packaging is fueling segment leadership.

-

Photonic Integrated Circuits (PICs): Projected to be the fastest-growing segment as these chips pack multiple optical functions into smaller, more efficient packages, substantially reducing power and cost.

-

Integration/Packaging Type: True packaged optics dominated in 2024 by delivering minimal signal loss and energy efficiency; however, on-board optics is expected to post notable gains, especially among Tier-2 and enterprise cloud providers seeking design flexibility.

-

Reach/Interconnect Length: Intra-rack connections led in 2024 for power and efficiency, while intra-package reach is poised for rapid adoption due to unparalleled density and minimal latency.

-

End Use: Data centers continued their dominance, driven by AI, cloud, and data analytics, while high-performance computing (HPC) emerges as a fast-growth area.

-

Distribution Channel: OEMs maintained majority share due to quality control and integration advantages; contract manufacturing partnerships are accelerating as scale needs surge.

Innovation & Competitive Landscape

CPO market participants are pressing ahead with innovations at all stages of the value chain:

-

Component Sourcing: Silicon wafers, indium phosphide, and gallium arsenide form the backbone of lasers and optical engines (Corning, Coherent, Shin-Etsu, Sumitomo Electric).

-

Optical Engine & PIC Design: Pioneered by Intel, Broadcom, Ayar Labs, and Marvell, combining photonics with advanced semiconductor design.

-

Advanced Packaging & Assembly: TSMC, NVIDIA, NeoPhotonics, and Lumentum push forward with 2.5D/3D packaging and automated fiber alignment.

-

Corporate Moves: Leading cloud and AI hardware firms (Google, Microsoft, NVIDIA) are investing heavily in CPO deployments. Notable projects include AI-driven quality control systems, silicon photonics product launches, and expanding contract manufacturing initiatives to accelerate time-to-market.

Challenges & Cost Pressures

Despite the strong growth trajectory, the market faces notable hurdles:

-

High Initial Costs: Integration of optics with electronics is capital intensive, posing barriers for non-hyperscale buyers.

-

Standardization Concerns: Lack of universal interfaces slows multi-vendor solution deployment, raising integration complexities.

-

Supply Chain Disruptions: Global trade policy changes affect semiconductor and photonic component availability, leading companies to explore alternative sourcing and manufacturing hubs.

-

Scalability Issues: Large-scale deployment demands consistent performance and cost efficiency; shortcomings can erode value propositions for major buyers.

Case Study: Data Centers Chart the Future

Data centers served as the dominant end-use segment in 2024, propelled by cloud computing, AI workloads, and the relentless quest for higher port density and energy savings. Market leaders modernized infrastructure through CPO platform adoption, achieving dramatic gains in bandwidth, scalability, and operational cost efficiency. This success continues to spark investment interest from both existing operators and new entrants seeking to harness the power of integrated photonics.

Read Also: U.S. Digital Health in Neurology Market Set to Surpass USD 103.32 Billion by 2034

Co-Packaged Optics Market Companies

- Broadcom

- NVIDIA

- Intel

- Marvell

- Ranovus

- Molex

- Coherent

- POET Technologies

- Ayar Labs

- Furukawa Electric

- SENKO Advanced Components

- Sumitomo Electric Industries

- Quanta Computer

- Cisco Systems

- IBM

- Kyocera

- TE Connectivity

- Ciena

- Huawei Technologies

For questions or customization requests, please reach out to us @ sales@precedenceresearch.com | +1 804 441 9344