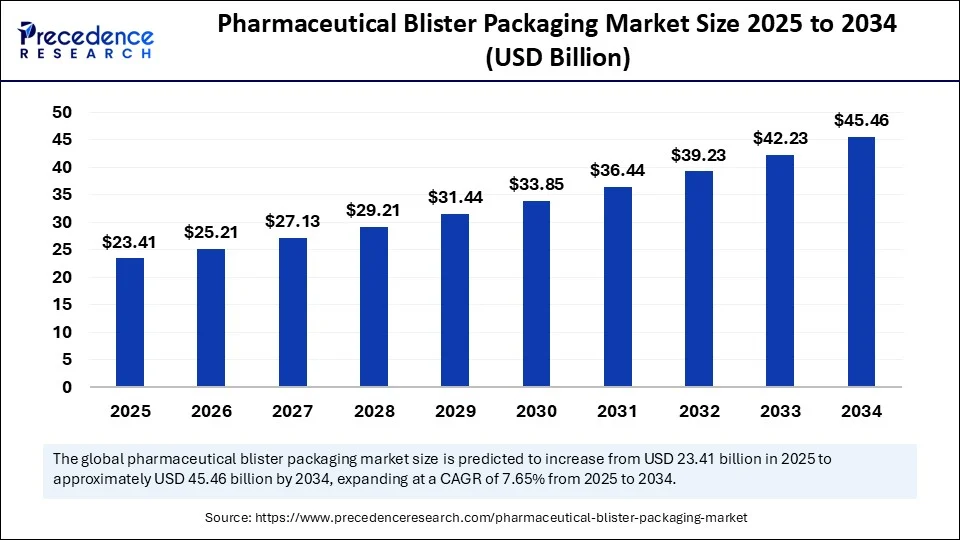

The global pharmaceutical blister packaging market is on a trajectory of strong growth, projected to nearly double in value from USD 23.41 billion in 2025 to approximately USD 45.46 billion by 2034, at a robust CAGR of 7.65%. Key growth drivers include the surge in e-pharmacies, escalating demand for tamper-evident packaging, ongoing innovations in cold form foil technology, and the expanding footprint of generic drug manufacturing.

Introduction: Solid Dosage, Smart Packaging, and Quality Control Redefine Pharma

The pharma sector continues to transform, with blister packaging emerging as a vital solution delivering tamper-resistance, modular dosage tracking, and enhanced drug protection. Major advances in AI-driven quality control, materials innovation, and the growth of digital healthcare channels are accelerating uptake across top markets, led by North America and Asia Pacific.

Quick Insights

-

2024 Market Value: USD 21.75 Billion

-

Estimated 2025 Value: USD 23.41 Billion

-

2034 Projection: USD 45.46 Billion

-

CAGR (2025–2034): 7.65%

-

Top Region by Market Share: North America (32% in 2024)

-

Fastest-Growing Region: Asia Pacific (CAGR 8.90%)

-

Largest Segment (2024): Thermoformed Blister Packs (65% share)

-

Fastest-Growing Packaging Innovation: Paper-Based Blisters (12.50% CAGR)

-

Top Material in 2024: Plastic-Based Films (55% share)

-

Leading Drug Form: Solid Oral Dosage (72% share in 2024)

-

Biggest Distribution Channel: Direct-to-Pharma (70% share)

-

Top End-User: Pharma Manufacturers (68% share)

Revenue Breakdown

| Market Metric | Value / CAGR |

|---|---|

| Market Size, 2024 | USD 21.75 Billion |

| Market Size, 2025 | USD 23.41 Billion |

| Market Size, 2034 | USD 45.46 Billion |

| CAGR (2025–2034) | 7.65% |

| Top Region (2024) | North America (32%) |

| Fastest-Growing Region | Asia Pacific (8.9%) |

Where Are the Biggest Opportunities and Most Notable Trends in Pharmaceutical Blister Packaging?

-

Rise of E-Pharmacies: The expansion of digital healthcare and decentralized delivery channels is fueling demand for robust yet patient-friendly packaging.

-

Tamper-Evident Technology: As regulators intensify scrutiny and consumers seek greater safety, tamper-evidence and anti-counterfeit solutions are propelling innovation.

-

Cold-Form Foil and Eco-Friendly Materials: Investments in cold-form foil and paper-based blisters cater to both product integrity and enhanced sustainability.

-

AI & Automation: Artificial intelligence now governs real-time monitoring, automating quality control to minimize defects—transforming manufacturing oversight from labor-intensive to error-proof.

-

Multi-Layer Laminates: Highest growth among materials (10.80% CAGR), supporting products with stringent barrier needs.

Expert Perspective

“The future of pharma packaging is smarter, safer, and more sustainable. Blister solutions are rapidly advancing, not just to secure drug integrity and patient compliance, but to deliver production efficiencies and environmental gains. The integration of AI, cold-form foils, and new biodegradable materials is a game-changer for global brands and generic manufacturers alike.”

– Dr. Ayesha Kapoor, Principal Consultant, Precedence Research

Regional Analysis: Who’s Leading, and Who’s Surging?

North America: Market Dynamo

With a 32% share in 2024 and projected growth to USD 10.42 billion by 2034 (CAGR 7.90%), North America continues to set the bar for innovation and regulatory compliance. The U.S. spearheads demand for tamper-evident, quality-assured packaging as chronic disease prevalence increases and digital pharmacy adoption soars.

Asia Pacific: Fastest Growth

Asia Pacific promises the highest CAGR (8.90%) through 2034. Drivers include rapid integration of IoT and automation, supportive government policy, and a marked consumer shift toward sustainable packaging. Expanding populations, rising healthcare access, and technological progress forecast strong regional momentum.

Europe, Latin America, Middle East & Africa

Europe maintains robust presence through regulatory rigor and established pharmaceutical hubs. Latin America and MEA represent emerging frontiers, offering long-term potential especially as online pharmacies and generic manufacturers proliferate.

Read Also: Agentic AI Market Size to Reach USD 199.05 Billion by 2034

Segmentation Overview: Innovation Across the Value Chain

-

By Blister Type: Thermoformed dominates with 65% (2024); multi-cavity packs dominate in strip segments (50% share).

-

By Material Composition: Plastic-based films lead (55%), with multi-layer laminates fastest-growing (10.80% CAGR). Paper-based blisters post double-digit gains for sustainability.

-

By Drug Form: Solid orals remain standard (72% share) for unit-dose, with transdermal patches gaining traction (9.60% CAGR).

-

By Technology: Thermoforming delivers cost-effectiveness and sustainability, holding 58% share.

-

By Functionality: Anti-counterfeit technologies grow fast (11.30% CAGR), meeting regulatory and patient demands.

-

By Packaging Format, Distribution Channel, End-User: Direct-to-pharma is the primary channel (70%); pharma manufacturers remain top end-users (68%).

Latest Breakthroughs and Leading Innovators

-

Cold-Form Foil Advances: Next-gen cold forming protects drugs from light, oxygen, and moisture—boosting shelf life and safety.

-

AI in Quality Control: Major pharmaceutical packagers adopt AI for packaging process inspections, ensuring error-free, micro-level defect detection, and seamless mass customization.

-

Paper-Based and Eco Blisters: Brands increasingly pivot to paper-based and environmentally sustainable blister formats—projected to grow fastest (13.40% CAGR).

-

Online Pharmacies: Rapid growth (14.10% CAGR) observed in online pharmacy distribution as digital-first models change how medicines reach patients.

Challenges and Cost Pressures

-

Barrier Limitations: Blister packs must continuously evolve to enhance resistance against moisture and oxygen ingress, especially for sensitive molecules.

-

Material Quality: Occasional packaging failures—due to subpar plastics or poor seals—can lead to product damage and dissatisfaction; brands must rigorously innovate in materials procurement.

-

Cost and Complexity: Integration of top-end anti-counterfeit or eco-friendly materials can drive up costs, necessitating scale and efficiency improvements across the supply chain.

Pharmaceutical Blister Packaging Market Top Companies

- Winpak

- WestRock

- VinylPlus

- Tjoapack

- Tekni-Plex

- Syensqo

- Sudpack

- Sonoco

- Romaco

- Rohrer

- Renolit

- Huhtamaki

- Honeywell

- Dow

- Constantia

- Carcano

- Caprihans

- Borealis

- Aptar

- Amcor

- ACG

Case Study: AI-Driven Quality Assurance in Blister Packaging

A leading North American pharmaceutical manufacturer implemented AI-powered inspection platforms for its blister packaging lines in 2024. The result? An 18% reduction in defects and an estimated USD 12 million in annual cost savings due to lower recalls and improved customer satisfaction. Real-time data allowed for immediate corrective action, reinforcing the critical importance of digital transformation in packaging operations.

Call to Action

Want to next-level your packaging strategy or explore the fastest-growing pharma packaging segments? Download a sample report now, schedule a discovery call with our expert team, or request a customized intelligence briefing.

Contact us:

-

Email: sales@precedenceresearch.com

-

Visit: Precedence Research